IBEX 35 companies Amadeus IT Group (ES:AMS) and Telefonica (ES:TEF) will report their Q4 and full-year earnings for 2022 this week.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Amadeus is right in the center of a growth wave, along with the bounce-back of the travel sector. The company is expected to post solid numbers, as the companies continues on its post-pandemic recovery.

On the other hand, Telefonica’s revenues are expected to slow down a bit in the future. Analysts have mixed opinions on the company’s stock performance as well.

Investors can stay informed throughout earnings season, across different markets, with the TipRanks Earnings Calendar. This tool guides investors with timely and updated information on upcoming earnings. It includes reporting date, result period, consensus EPS forecast, previous year’s EPS, etc. The tool is helpful for existing and new investors in tracking these stocks and conducting in-depth research later on.

Let’s have a look at AMS and TEF in detail.

Amadeus IT Group, S.A.

Amadeus is among the leading technology companies in the world, providing IT solutions to the travel and tourism industry.

The company will announce its Q4 and full-year 2022 results on February 24, 2023. The consensus EPS forecast for the quarter is €0.39 per share. This is significantly higher than the EPS of €0.08 per share in the same quarter of 2021.

Thanks to the revival of the travel industry worldwide, Amadeus has completed the year with solid operational growth. In third quarter of 2022, the company posted a huge growth of 880% in its EPS of €0.49 per share on a year-over-year basis. The company also beat analysts’ estimates by around 14%. The company’s revenue of €1.2 billion in Q3 has already reached more than 85% of pre-pandemic levels.

Analysts expect the company to continue this trend and surpass its pre-pandemic growth in the coming quarters. The expected sales for Q4 are around €1.18 billion. The forecasted net sales for the year 2022 is at €4.48 billion, as compared to €2.6 billion in 2021. The net income is expected to be €666 million, which will outperform the loss of €142 million in the previous year.

After reporting its 2022 results, the company is planning to resume its dividend payments in 2023, following a dry spell of three years.

Amadeus Share Price Forecast

The company’s stock has gained 15.7% YTD, riding on its recovery in the travel industry.

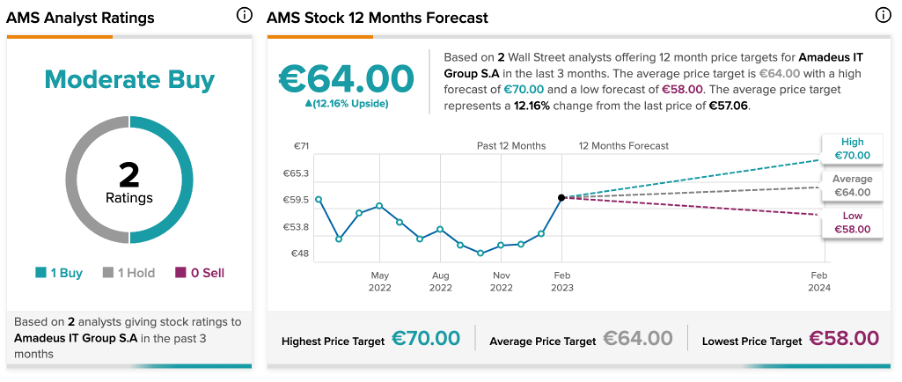

Overall, AMS stock has a Moderate Buy rating, based on one Buy and one Hold recommendation. The average target price is €64, which represents a change of 12% from the current price level.

Telefonica S.A.

Telefonica is a global telecommunications company known for its high-speed internet and extensive coverage network in Europe and the U.S. The company enjoys a dominant position in its network infrastructure for fixed and mobile services.

The telecom giant will report its 2022 annual results this week, on February 23. According to TipRanks, analysts predict an EPS of €0.10 per share in Q4. A year ago, the EPS was €0.07 in the same quarter.

The forecasted revenues for the quarter, at €10.08 billion, is slightly down from €10.34 billion in the previous quarter. The Q3 revenue beat analysts’ expectations and increased by 12%, but moving forward, a slowdown is expected in the company’s growth. Analysts believe higher debt levels and increased competition in Europe could hamper the revenues and earnings of the company.

The expected profit in the fourth quarter is €612 million.

Is Telefonica a Buy or Sell?

According to TipRanks, TEF stock has a Hold rating, based on a total of 7 recommendations. The average target price of €3.67 is 4% lower than the current trading level.

The stock has been trading up by 11% YTD, after having fallen by 5.6% in the last year.

Conclusion

Between these two companies who are reporting their 2022 annual results this week, Amadeus seems more promising. AMS stock has bullish opinions from analysts and also has a Buy rating. In contrast, analysts have a Hold rating for Telefonica’s stock and see slightly sluggish revenue growth in the short term.