The share price of Amadeus IT Group S.A. (ES:AMS) gained around 5% after Q3 profits soared as air traffic recovered. The management attributed the results to “robust operational achievements” and the overall recovery of the travel industry during the quarter.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company has maintained its full-year outlook. However, it cautioned that the travel industry’s recovery decelerated in the third quarter. It expects a growth of 20%-22.5% in its revenues in 2023.

Amadeus IT Group specializes in delivering IT solutions primarily designed for the worldwide travel and tourism industries.

Q3 2023 Numbers Snapshot

The company reported an adjusted net profit of €315.5 million in its Q3 2023 earnings report, which is 44% above last year’s numbers. The revenues increased by 14% to reach €1.39 billion, surpassing the analysts’ consensus of €285 million. In Q3, the EBITDA increased by 21.6% to €547.7 million as compared to €450.4 million reported a year ago.

The bookings during the quarter expanded by 12.7% as the Asia Pacific emerged as a winner after the Chinese economy opened up following the pandemic. In the nine months, bookings grew by 15.7% to 348 million.

During the results, the company also announced a new share buyback program for €625 million, equivalent to 8.8 million shares.

What is the Stock Price Forecast for Amadeus?

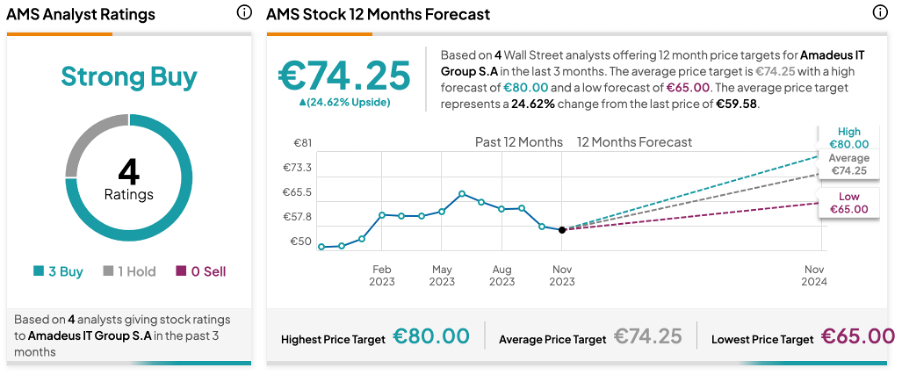

Following the release of the results, analyst Charles Brennan from Jefferies reaffirmed his Buy rating on the stock, projecting a 26% growth rate in the share price.

As per the consensus among analysts on TipRanks, AMS stock has been assigned a Strong Buy rating based on three Buy and one Hold recommendations. The Amadeus share price target is €74.25, which signifies a potential change of 25% from the current share price.