Shares of the UK-based Associated British Foods PLC (GB:ABF) gained almost 6% yesterday after the company raised its annual profit guidance, driven by solid sales growth. In its pre-close trading update for FY23, issued ahead of its full-year earnings in November, the company increased its profit projections for the second time in just four months. The company is optimistic about its retail brand Primark and expects it to generate higher sales and better margins.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Investors were impressed with the numbers, as reflected in the share price growth. YTD, the shares have shown strong performance, surging 24% and outperforming the FTSE 100 index.

Associated British Foods PLC is a diversified global company focused on food and ingredients, along with its retail brand Primark. The company has a global presence in more than 100 countries.

Improved Numbers and Brighter Outlook

For the full year, the company expects its operating profit to be slightly higher than its previous expectations.

For Primark, sales are expected to reach approximately £9.0 billion, marking a 15% increase compared to the previous year, accompanied by a like-for-like sales growth of 9%. This growth is mainly attributed to the performance of newly opened stores, the company’s product lines, and pricing policy. The retailer’s adjusted operating profit margin is projected to be around 8% in FY23.

In FY24, the company is placing significant emphasis on Primark and its Sugar brand within the food segment, with expectations that their gross margin will further improve. In recent weeks, the company has already observed favourable developments in its material and freight expenses, as well as the strengthening of the euro and pound relative to the dollar.

Is Associated British Foods a Good Buy?

Analysts like ABF stock for its diversification. The different segments of the company perform well across various economic cycles, providing a safe cushion to investors. This resilience was especially evident during the lockdown period.

Post-update, yesterday, analyst Simon Irwin from Credit Suisse reiterated his Buy rating on the stock, forecasting a 23% upside in the share price. Goldman Sachs analyst Richard Edwards also confirmed his Hold rating on the stock yesterday.

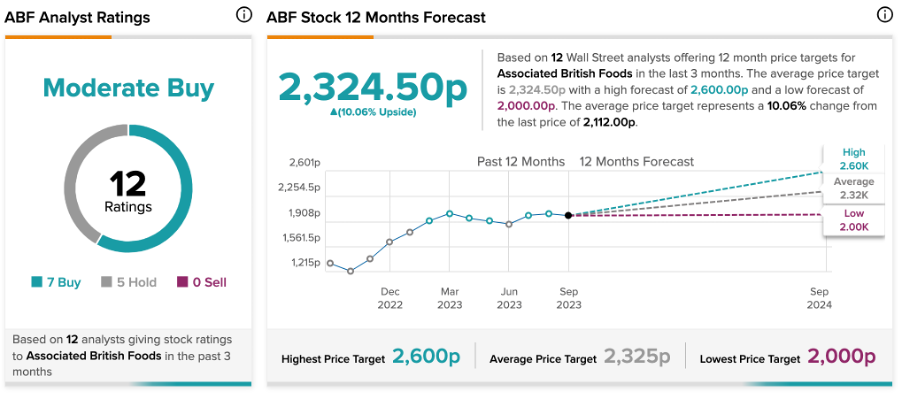

According to TipRanks, ABF stock has a Moderate Buy rating based on seven Buy and five Hold recommendations. The AB Foods share price prediction is 2,324.5p, which is 10% higher than the current trading level.