GlaxoSmithKline (GSK) has turned down three unsolicited and non-binding takeover proposals for its Consumer Healthcare business from Unilever plc. (UL). The unit is a joint venture between the giant drug maker and Pfizer (PFE). GSK holds a majority stake in the unit at 68% and Pfizer the remaining 32%. GSK shares rose 0.60% to close at £16.41 on January 14.

GlaxoSmithKline is a global healthcare company that develops and manufactures medicines, vaccines, and consumer healthcare products. GlaxoSmithKline earnings report for Q4 2021 is scheduled for February 09, 2022. GSK dividends have increased over the past two months. The company currently boasts of a a dividend yield of 1.4%.

The Consumer Healthcare Unit

The latest proposal from Unilever valued the consumer healthcare unit at £50 billion, made up of £41.7 billion in cash and £8.3 billion in Unilever shares. GlaxoSmithKline says it rejected all the acquisition proposals because they fundamentally undervalue the unit and its prospects.

The Consumer Healthcare Business came into being in 2014 on the integration of GlaxoSmithKline’s business with the Novartis consumer health portfolio, and later with the Pfizer portfolio in 2019. The integration has led to the divesting of lower growth brands and the introduction of new research and development models.

Additionally, the joint venture has optimized the supply chain and manufacturing network. The unit has also invested in new digital data and analytics platforms.

The result has been a global consumer healthcare business that generated £9.6 billion in sales in 2021. Between 2019 and 2021, the Consumer Healthcare business delivered a 4% organic sales growth CAGR.

Stock Rating

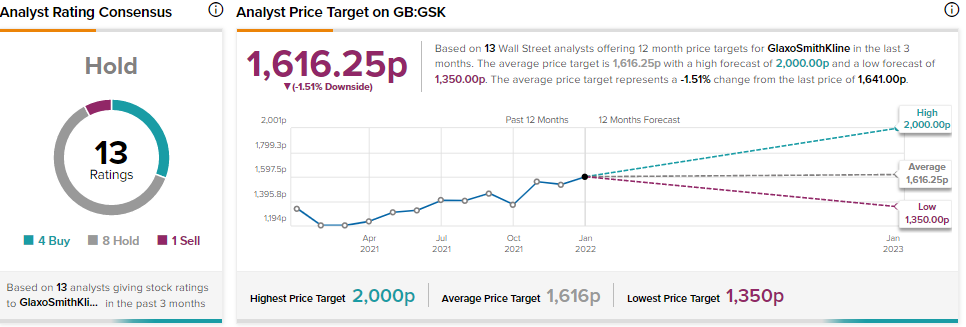

Early this month, JPMorgan analyst James Gordon reiterated a Hold rating on the stock with an average price target of 1,710p implying 4.20% upside potential to current levels. The analyst sees near-term trade into GSK’s consumer unit separation but remains cautious about the company’s long-term ability to rebuild the pipeline ahead of the patent expiration of its HIV drug, dolutegravir, in 2028/2029.

The consensus among analysts is a Hold based on 4 Buys, 8 Holds and 1 Sell. The average GlaxoSmithKline Beverage price target of $1,616.25p implies 1.519% downside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.

Related News:

Jack Dorsey Continues Feud with a16z, Posts Piece Professing Portly Profits for VCs

Tesla and the Indian Market: Tougher Than Expected

Boeing Blasts Up on a Possible Return to Chinese Skies