GFL Environmental Inc. (NYSE: GFL) has announced rewards for shareholders in the form of a 10% hike in the quarterly dividend rate. The news sent a positive signal about the company’s financial well-being and cash position, evident from share-price movements on Thursday.

Shares of GFL Environmental gained 7.1% to close at $33.15 on Thursday. In the extended trading session, the shares grew 0.2%.

The provider of environmental services is headquartered in Vaughan, Ontario. It specializes in the management of solid and liquid waste as well as provides infrastructure-related & soil remediation services.

Inside the Headline

The quarterly dividend hike of $0.01 per share has been approved by GFL Environmental’s board of directors. The new rate now stands at $0.12 per share and will be paid to all shareholders mentioned in the company’s record as of April 18.

The disbursement of dividends will be on April 18.

With this hike, GFL Environmental’s annual dividend rate now stands at $0.48 per share, compared with the previous rate of $0.44 per share.

Robust Cash Positions and Financials

In 2021, GFL Environmental’s adjusted cash flow from operating activities surged 39.9% year-over-year to $1,080.2 million, and its adjusted free cash flow was up 50.1% to $540.3 million. Exiting 2021, the company’s cash was $190.4 million, way above $27.2 million recorded at the end of 2020.

In 2021, the company distributed dividends totaling $17.9 million, up from $13.1 million in 2020. In April 2021, the company hiked its dividend rate by 10% ($0.01 per share) to $0.11 per share.

For 2022, the company anticipates adjusted revenues to increase 14%-16% year-over-year to $5,825-$5,925 million. It predicts an adjusted free cash flow of $625-$655 million, reflecting a 23% to 28% year-over-year increase.

Stock Rating

Last month, Stephanie Yee, an analyst with J.P. Morgan, yet again started covering GFL Environmental. It reinstated the coverage on the stock with a Buy rating and a price target of $41 (23.68% upside potential).

The analyst is optimistic about the company’s growth prospects “through acquisitions and leveraging its larger solid waste platform.”

The company has a Strong Buy consensus rating based on seven Buys. GFL Environmental’s price forecast of $44.46 suggests 34.12% upside potential from current levels. Over the past year, shares of GFL Environmental have declined 6.7%.

Investors’ Sentiment

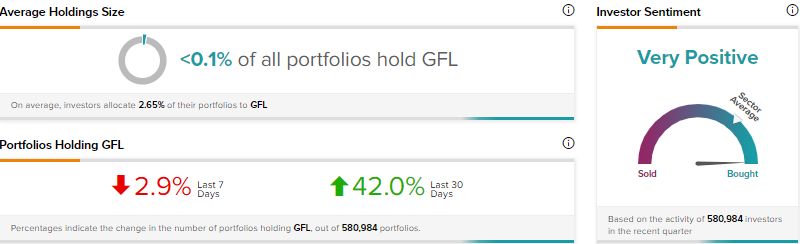

Per TipRanks’ Stock Investors tool, investors currently have a Very Positive stance on GFL Environmental. In the past 30 days, there has been an increase of 42% in the number of portfolios having exposure to the GFL stock.

Conclusion

Impressive financial projections and solid cash holdings have well-positioned GFL Environmental to keep rewarding shareholders with dividend payments.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Murphy Oil Corporation Bumps up Quarterly Dividend by 17%

Walgreens: Dividends and Valuation Indicate a Bargain

Northrop Grumman: Is Its Dividend Growth Worth It?