Shares of renewable fuels company Gevo, Inc. (GEVO) have surged a massive 542% over the past 12 months. In its recent Q3 results, Gevo missed on the revenue front; however, its bottom-line met the analysts’ expectations.

Keeping these developments in mind, let us take a look at the changes in Gevo’s key risk factors that investors should know.

Risk Factors

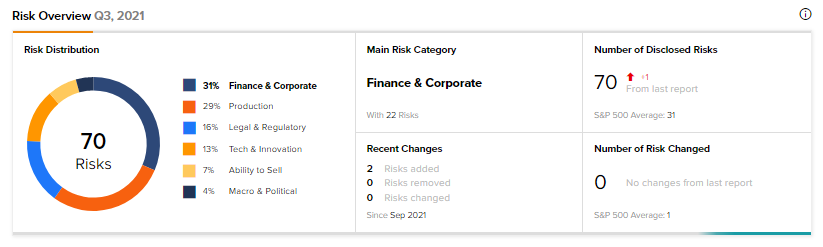

According to the TipRanks Risk Factors tool, Gevo’s top two risk categories are Finance & Corporate, and Production, accounting for 31% and 29% of the total 70 risks identified, respectively. In its recent Q3 report, the company has added two new key risk factors under the Finance & Corporate risk category.

Firstly, Gevo noted that it needs stockholder approval to amend its certificate of incorporation to increase the authorized shares of common stock available for issuance. Without the approval and subsequent amendment, the company may not be able to issue additional shares to raise capital in the future or for strategic transactions.

Operating in a capital-intensive industry, Gevo admits its current ~34.43 million common shares available for future issuance may not be sufficient to obtain funding to execute its business plans.

Secondly, Gevo believes it will continue to expend significant resources in the future on developing its business, and the company will need sizable financing to achieve its goals. Any failure to raise capital when required or on acceptable terms could force Gevo to delay, decrease, or stop its development and commercialization efforts. (See Insiders’ Hot Stocks on TipRanks)

Compared to a sector average of 34%, Gevo’s Finance & Corporate risk factor is at 31%.

Wall Street’s Take

In response to Gevo’s Q3 performance, Noble Financial analyst Poe Fratt reiterated a Buy rating on the stock with a price target of $16.

According to Fratt, Gevo’s negative earnings before interest, taxes, depreciation, and amortization (EBITDA) during the quarter was not a surprise. The concept of development of renewable fuels is still in the early stage, and Fratt expects to see EBITDA losses into late next year as well.

Additionally, the analyst also noted that while Gevo’s contract portfolio remained unchanged, its development pipeline continues to expand, and new large contracts appear on the horizon.

Consensus on the Street is a Strong Buy based on 3 unanimous Buys. The average Gevo price target of $14.67 implies a potential upside of 113.54% for the stock.

Related News:

Warby Parker Posts Strong Q3 Results; Shares Up 9%

Compugen Posts Q3 Loss; Shares Drop 18%

Zevia PBC Reports Mixed Q3 Results; Shares Drop