Shares of the visual media company, Getty Images Holdings (NYSE: GETY) surged in morning trading on Monday after Trillium Capital announced a non-binding proposal to acquire Getty for $10 per share in cash.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

However, Trillium added that this proposal was dependent upon a number of things. This includes, “immediate engagement by the Board of Directors of Getty (the “Board”), completion of satisfactory due diligence, obtaining satisfactory financing arrangements, entering a satisfactory purchase & sale contract, filing and completion of all regulatory matters related to our non-binding proposal and approval of shareholders.”

Trillium also stated that it was willing to consider allowing the holders of the large block of shares of Getty including The Getty Family, Koch Industries, and Neuberger Berman, currently holding over 80% of the shares outstanding to “roll some or all their shares into our transaction.” If this acquisition is successful, the “principals of Trillium Capital will hold their shares of common stock of the Company.”

In case of this proposal is accepted, Trillium expects that its Managing Partner will be the Chairman of Getty’s Board of Directors.

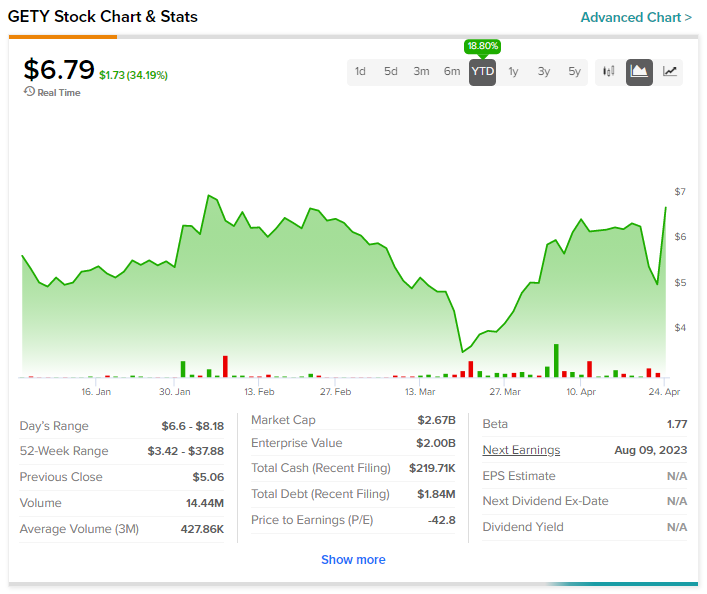

GETY stock has soared by more than 18% year-to-date.