George Soros, the billionaire hedge fund CEO of Soros Fund Management has made some major changes to his hedge fund’s positions in different stocks. According to a 13-F filing from the hedge fund, the billionaire investor has reduced his positions in a number of stocks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This includes reducing his position in Amazon (AMZN) to 901,400 thousand shares from earlier 1.98 million shares and Rivian Automotive (RIVN) to 14.3 million shares from prior 16.4 million shares.

Soros also slashed his positions at Nike (NKE) to 63,720 thousand shares and D.R. Horton (DHI) to 692,600 thousand from an earlier 2.6 million.

Interestingly, Soros loaded up on Tesla (TSLA) stock in Q4, lifting its stake in the EV major to around 47% with 132,000 shares. TSLA stock was up in morning trading following the news.

While Soros exited completely from its stakes in Zoom Video Communications (ZM), Elanco Animal Health (ELAN), and Las Vegas Sands (LVS) among others, it took new positions in Vail Resorts (MTN), with 120 thousand shares, and Horizon Therapeutics (HZNP), with 2.86 million shares.

Soros increased his stakes in Disney (DIS) and Alphabet (GOOGL) to 189,600 thousand and 1.76 million shares, respectively.

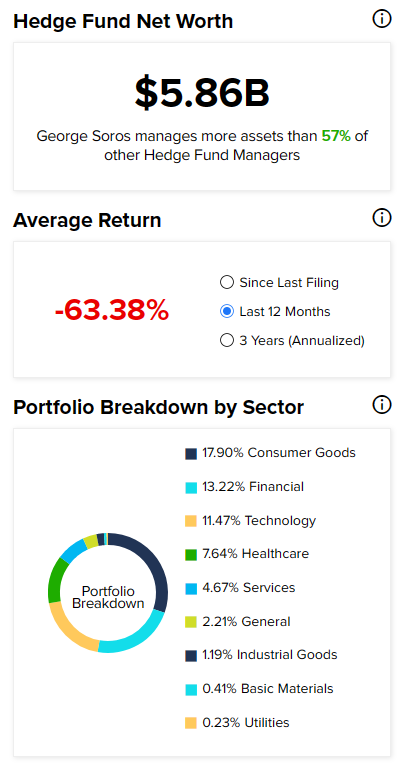

Over the last year, Soros Fund Management has given a negative average return of 63.4%.