Genocea Biosciences announced that the US Food and Drug Administration (FDA) has accepted the Investigational New Drug (IND) application for its GEN-011 cancer immunotherapy, sending shares up 5% in Tuesday’s pre-market session.

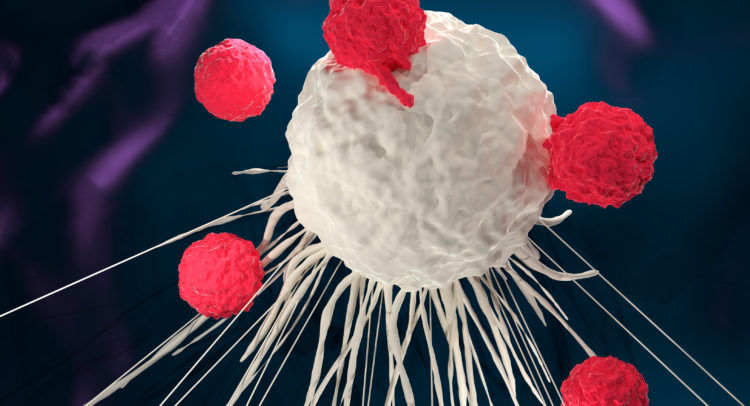

Genocea (GNCA), which is developing next-generation neoantigen immunotherapies in multiple tumor types, said that following the IND acceptance, it will initiate a Phase 1/2a clinical study of GEN-011 in patients who have failed standard-of-care checkpoint inhibitor therapy. The trial will evaluate safety, T cell proliferation and persistence as well as clinical activity.

GEN-011 is an adoptive T cell therapy targeting neoantigens and is designed to improve upon the limitations of tumor-infiltrating lymphocytes (TIL) and T-cell receptors (TCR) therapies.

“GEN-011 builds on the power of our ATLAS platform, as demonstrated in our GEN-009 clinical trial, to identify the relevant neoantigens which drive robust anti-tumor T cell responses in patients,” said Genocea CEO Chip Clark. “Using a patient’s peripheral T cells, already programmed to kill cancer cells with relevant neoantigens, enables this non-engineered therapy to rapidly scale. We therefore believe GEN-011 may eventually offer efficacy, accessibility and cost advantages to patients and providers.”

Genocea plans to enroll up to 24 patients across several tumor types in the Phase 1/2 trial. In one cohort, patients will receive multiple low doses of GEN-011 with low-dose IL-2 and without lymphodepletion. In the other cohort, patients will receive a single GEN-011 dose after lymphodepletion and a high dose of IL-2.

Shares in Genocea are already up 12% so far this year, with the $10.50 average analyst price target implying a whopping 353% upside potential lies ahead.

Needham analyst Chad Messer last week maintained a Buy rating on the stock with a $7 price target (202% upside potential).

“We believe GNCA is undervalued versus peer neo-antigen cancer vaccine companies despite Genocea’s early clinical stage,” Messer wrote in a note to investors. “We base our price target on a projected $500M enterprise value, which we view as a modest premium to the median value of comparable companies in the space. To that we add YE:20 estimated cash of $75M and subtract Hercules debt arriving at $561M.”

The rest of the Street shares Messer’s bullish outlook. The Strong Buy analyst consensus boasts 4 unanimous Buy ratings. (See GNCA stock analysis on TipRanks)

Related News:

Teva Launches Two Digital Inhalers For Asthma Patients

Illumina Confirms $8B Acquisition Of Cancer-Detection Firm Grail

AstraZeneca-Merck’s Lynparza Gets Recommended By EU For Prostate, Ovarian Cancers