General Motors (NYSE:GM) and LG Energy Solution have agreed to inject another $275 million into their joint venture (JV) battery plant, which is currently under construction. The investment is expected to boost battery cell production at the plant by 40%.

The recent investment goes beyond the $2.3 billion that both companies pledged to spend on building a battery plant in Spring Hill, Tennessee. The 2.8-million-square-foot plant is expected to be operational in late 2023.

Owing to the growing demand for EVs, the companies have formed a JV to produce battery cells for electric vehicles in large quantities. Apart from Tennessee, two of the battery plants are located in Michigan and Ohio.

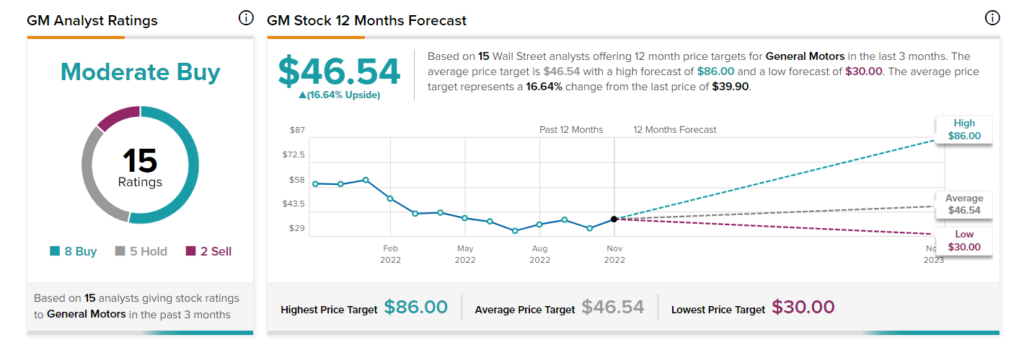

Is GM a Buy Stock?

General Motors’ investments in the EV space might keep the bottom line under pressure in the near term, but they bode well for long-term growth due to the strong pick-up in its demand globally. It is worth noting that the company expects its EV investments to turn profitable by 2025. Moreover, it expects to launch about 30 EVs globally by 2025, with the final goal of selling solely electric cars by 2035.

Overall, the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating based on eight Buys, five Holds, and two Sells. The average stock price target of $46.54 implies 16.64% upside potential from the current level.