After China’s recent threat of curbs on rare earth exports put automakers on the hot seat, legacy automaker General Motors (GM) appears to be intensifying its efforts to reduce its reliance on parts supplies from China.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

According to Reuters, General Motors has instructed thousands of its suppliers to eliminate Chinese components from their supply chains. The Detroit-based company has even given some suppliers a 2027 deadline to achieve this aim, the outlet reported, citing insider sources.

While China has lifted its mineral export curbs following the recent talks between U.S. President Donald Trump and Chinese leader Xi Jinping in Busan, South Korea, the automaker appears wary of the volatile nature of the trade war between the two countries and the impact of disrupted Chinese parts supplies.

GM Reassesses Chinese Parts Supply Chain

The latest disclosure comes as General Motors has been reassessing its Chinese parts supply chain after the Trump administration imposed a 10% tariff on the country earlier in the year. This is even as the carmaker reportedly initiated the restructuring of its operations in the Asian country, pulling the plug on one of its plants.

General Motors’ renewed pressure on parts suppliers to eliminate components from China also extends to simple components, the outlet said. The push comes as General Motors has joined other automakers such as Tesla (TSLA) and Toyota Motor (TM) to pressure the Trump administration to extend the United States-Mexico-Canada Agreement on trade.

Most automakers operate manufacturing plants in all three countries and rely on the unrestricted movement of vehicle parts, workforce, and finished vehicles across the countries.

Is GM a Good Stock to Buy Today?

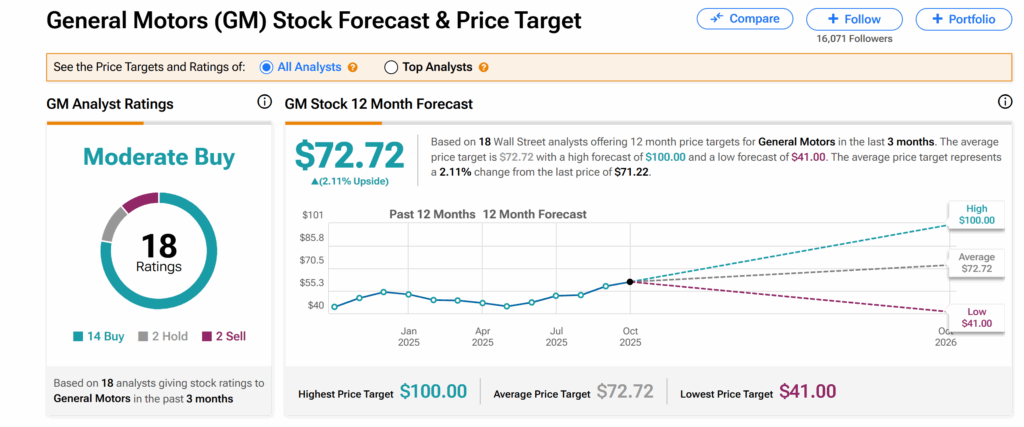

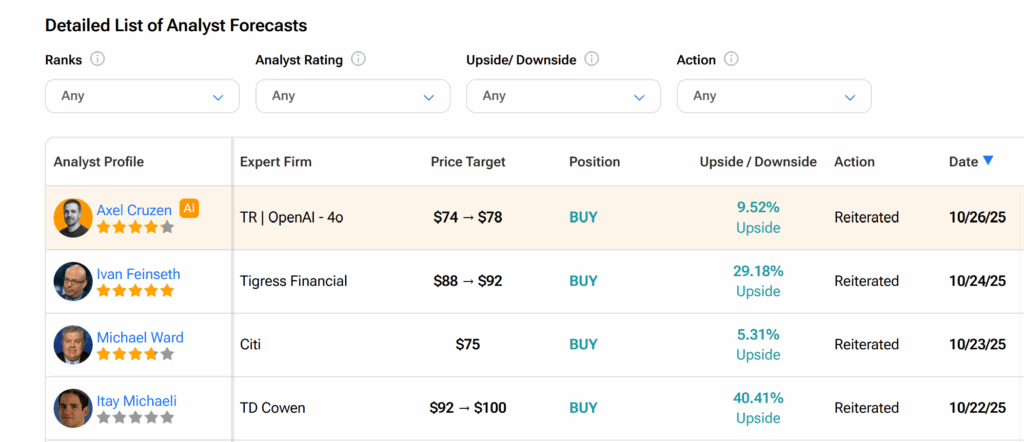

Turning to Wall Street, General Motors’ shares currently have a Moderate Buy consensus rating. This is based on 14 Buys, two Holds, and two Sells issued by 18 analysts over the past three months.

At $72.72, the average GM price target indicates about 2% upside potential from the current trading level.