General Motors (GM) is scheduled to report its Fiscal third-quarter financial results on October 22, and Wall Street expects modest growth from the Detroit automaker.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The consensus view of analysts is for GM, as the company is commonly known, to report earnings per share of $2.38. That would represent growth of 4% from earnings of $2.28 a year earlier.

The company has exceeded earnings estimates in each of its last eight quarterly financial reports. GM is entering its Fiscal Q3 print with its stock having gained nearly 37% so far this year, outpacing the benchmark S&P 500 index that is up 23% year-to-date.

Bulls vs. Bears

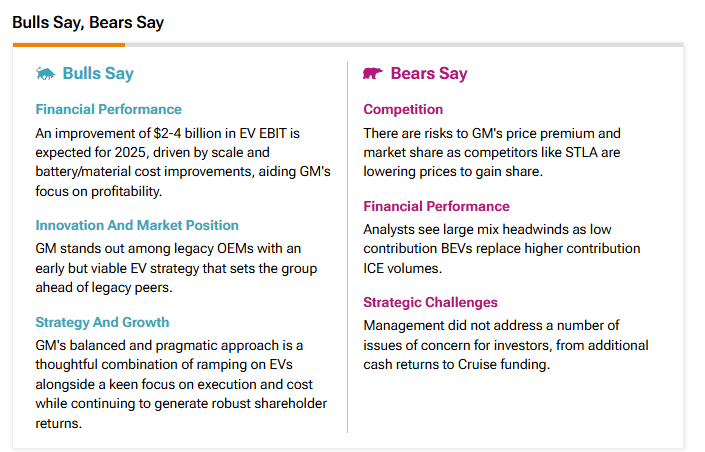

TipRanks Bulls Say, Bears Say tool offers insights into analysts view of General Motors heading into the company’s print. The bulls like that GM is continuing to invest in electric vehicles and improving its costs related to batteries and other materials.

On the flipside, bears are concerned about the intense competition in the electric vehicle sector, where price discounts have become commonplace and competitors are trying to undercut GM’s position in the market.

Is GM Stock a Buy?

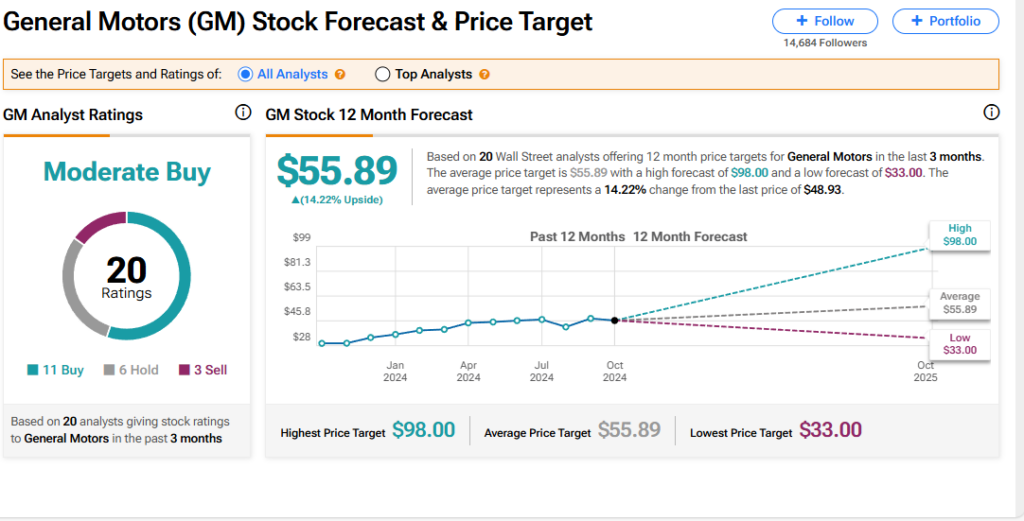

General Motors’ stock has a consensus Moderate Buy rating among 20 Wall Street analysts. That rating is based on 11 Buy, six Hold, and three Sell recommendations made in the last three months. The average GM price target of $55.89 implies 14.22% upside potential from current levels.