General Motors (GM), an American multinational automotive manufacturing company, has acquired a 25% ownership stake in Seattle-based Pure Watercraft. The financial terms of the deal have been kept under wraps.

Following the news, shares of the company rose 3.6% to close at $64.06 on Monday.

Markedly, Pure Watercraft is specialized in creating all-electric boating solutions. The Pure Outboard from Pure Watercraft benefits a boat’s performance with the reduction of environmental pollution and records much lower operating and maintenance costs compared to traditional marine propulsion systems.

Benefits of the Acquisition

Through this acquisition, GM technology combined with Pure Watercraft propulsion systems will expand all-electric marine transportation.

The GM and Pure Watercraft partnership depicts the expansion of zero-emissions mobility for future generations and a step ahead of increasing EV adoption.

Furthermore, Pure Watercraft’s innovative marine propulsion technology and experience in the commercial marine industry, along with GM’s engineering, supply chain and manufacturing capabilities, will leverage the entire deal. Markedly, battery-electric watercraft will be developed and commercialized, along with the integration of GM technology, into a variety of applications. This, in turn, will accelerate the industry’s transition to electric mobility.

Notably, through 2025, GM has plans to invest $35 billion in electric and autonomous vehicle technology to gain significant market share in EVs in North America.

See Insiders’ Hot Stocks on TipRanks >>

Official Comments

The Vice-President of Global Electrification, Controls, Software and Electronics at GM, Dan Nicholson, said, “GM’s stake in Pure Watercraft represents another exciting opportunity to extend our zero-emissions goal beyond automotive applications. Building upon GM’s existing efforts to strategically deploy our technology across rail, truck and aerospace industries, the combined expertise of these two enterprises should result in future zero-emissions marine product offerings, providing consumers with more choice than before.” (See General Motors stock charts on TipRanks)

Analysts Recommendation

On November 14, Wedbush analyst Daniel Ives maintained a Buy rating and a price target of $85 (32.7% upside potential) on the stock.

Ives said, “We believe the GM EV transformation story heading into 2022 is starting to get recognized by the Street as we believe an EV driven re-rating is now in process.”

“Looking through near-term issues (chip issues, Bolt recall) as we head into 2022/2023 we believe GM has a golden opportunity to lay the groundwork and ultimately convert 20% of its massive customer base to EVs by 2026 and north of 50% by 2030,” the analyst added.

Consensus among analysts is a Strong Buy based on 12 Buys and 1 Hold. The average General Motors price target of $74 implies 15.5% upside potential from current levels. Shares have gained 43.1% over the past year.

Website Traffic

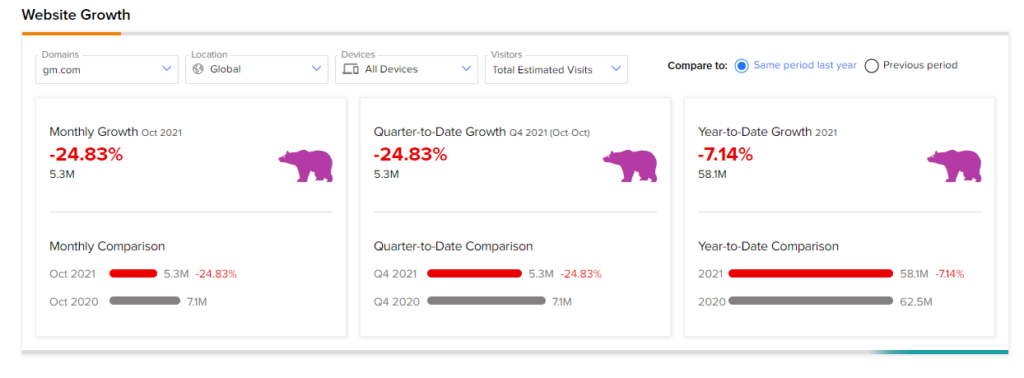

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into General Motors’ performance.

According to the tool, the website of General Motors recorded a 24.83% monthly decline, year-over-year, in global visits in October. Notably, year-to-date website growth, compared to year-to-date website growth in the previous year, has declined 7.14%.

Related News:

XPeng Launches New Electric SUV

Gilead Submits Biologics License Application for Bulevirtide; Shares Rise

Moderna’s COVID-19 Booster Dose Bags FDA Nod for Adults