General Mills reported better-than-anticipated results for the second quarter of fiscal 2021 (ended Nov. 29) as the demand for the company’s products continued to be strong due to elevated at-home food consumption resulting from the pandemic.

Net sales increased 7% year-over-year to $4.72 billion, beating analysts’ forecast of $4.65 billion. General Mills’ (GIS) top line growth was driven by higher sales in North American retail, pet and international businesses. However, sales from the convenience stores and foodservice channel continued to be a drag.

The company’s adjusted EPS increased 12% to $1.06, exceeding analysts’ consensus estimate of $0.97. Earnings growth was backed by margin expansion and lower net interest expense. (See GIS stock analysis on TipRanks)

Coming to the guidance, General Mills expects the COVID-19 pandemic to drive continued demand for its products. It anticipates 3Q organic net sales growth roughly similar to the second quarter’s growth rate of 7%, and an adjusted operating profit margin in line with the year-ago period.

Following the print, Jefferies analyst Robert Dickerson reiterated a Hold rating and a price target of $64, saying, “Driven by the Q2 beat and 2H commentary, we’re increasing our FY’21 EPS forecast by ~6% to $3.80, with our FY’22 & FY’23 EPS ests moving up by ~3%, as we’ve been in incremental margin flex and potentially less y/y top-line declines as the co’s bigger brands continue to perform on a share basis.”

Dickerson remains on the sidelines as he feels that cost headwinds and near-term margin expansion concerns are “likely to linger” and valuation looks fair.

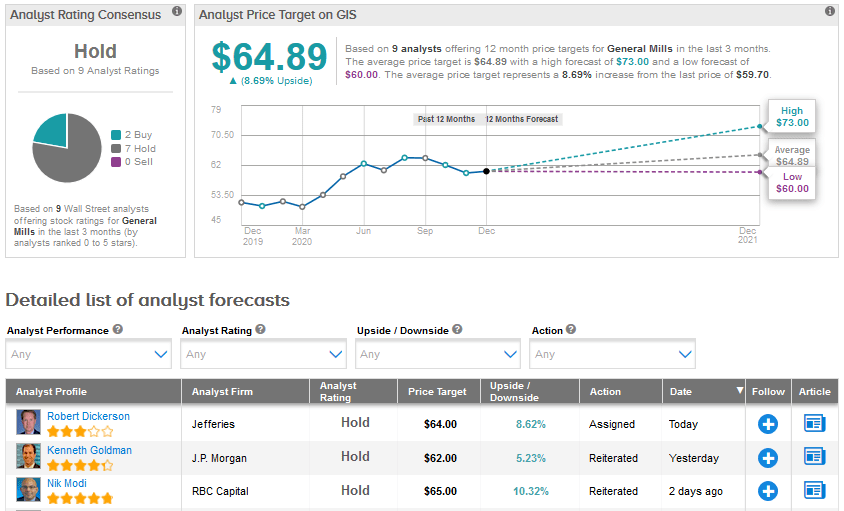

The rest of the Street is also sidelined on the stock, with a Hold analyst consensus based on 2 Buys and 7 Holds. The average price target of $64.89 indicates an upside potential of 8.7% in the months ahead. Shares have risen 11.5% year-to-date.

Related News:

AAR Misses Q2 Street Estimates; Shares Plunge 5%

U.S. Steel Dips 6% On Higher-Than-Feared Loss Outlook, Street Sees 47% Downside

Accenture Gains 7% On Blowout 1Q Results; RBC Lifts PT