Shares of capacity solutions provider USA Truck, Inc. (USAK) have gained 124% so far this year. Recently, it delivered better-than-expected third-quarter Fiscal 2021 performance.

Let’s look at USAK’s third-quarter Fiscal 2021 financials and understand what has changed in its key risk factors that investors should know.

On the back of a 16.2% rise in the Trucking segment and a 56.7% increase in the USAT Logistics segment, revenue increased 27.7% year-over-year to $181 million, beating the consensus estimate by $4.4 million.

Notably, base revenue per available tractor per week increased by $689 due to an increase in base revenue per loaded mile.

The President and CEO of USAK, James Reed, said, “For the third quarter, the combined effect of the market dynamics and our execution saw our Trucking segment adjusted operating ratio improve 50 basis points year-over-year to 95.3%.

“USAT Logistics load volume increased 14.4% with operating revenue up 56.7% year-over-year and adjusted operating ratio improved by 250 basis points year-over-year to 95.5%. We are proud of our progress and especially of our people who continue to improve results day after day.” (See Insiders’ Hot Stocks on TipRanks)

Earnings per share at $0.57 outperformed estimates by $0.07. The company had posted earnings per share of $0.29 in the same quarter last year.

On November 1, Cowen & Co. analyst Jason Seidi reiterated a Buy rating on the stock and increased the price target to $30 from $28, implying upside potential of 54%.

Seidi noted that the third-quarter performance was ahead of his estimates as USAK continued to exceed its financial objectives. The analyst sees further scope for upside if USAK’s trucking initiatives continue to pan out.

Now, let’s look at what’s changed in the company’s key risk factors.

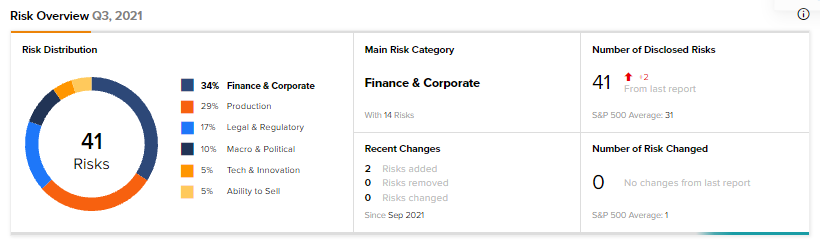

According to the new Tipranks’ Risk Factors tool, USAK’s top risk category is Finance & Corporate, which accounts for 34% of the total 41 risks identified. In its recent third quarter report, the company has added two key risk factors under the Legal & Regulatory and Production risk categories.

Under the Legal & Regulatory risk category, USAK highlights that the proposed new rule requiring mandatory COVID-19 vaccination of employees could adversely impact the company. At present, it remains unclear if the new rule will include an exception for professional truck drivers. Implementation of the rule may lead to employee churn over, increased expenses, logistical issues and lower revenue. Additionally, a vaccination mandate may also decrease the available pool of drivers.

Under the Production risk category, USAK notes that difficulty in procuring materials, equipment, goods and services from vendors and suppliers may negatively impact the company. The present business environment amid the COVID-19 pandemic is leading to the shortages of semiconductor chips and other components for tractor and trailer manufacturers. Curtailing of production by manufacturers has led to a reduced supply of tractors and trailers, increased prices and longer trade cycles, which could impact USAK negatively.

The Production risk factor’s sector average is at 24%, compared to USAK’s 29%.

Related News:

Amazon Drops 4% after Missing Q3 Expectations and Muted Q4 Outlook

AptarGroup Reports Q3 Earnings In Line with Expectations, Sales Beat

Logitech Posts Mixed Fiscal Q2 Results