Shares of apparel retail company, GAP, Inc. (GPS) have climbed about 9.8% over the past five trading sessions as investors shed global macro jitters. Despite this uptick, the stock is still 15.6% lower so far this year. Its portfolio of brands includes Old Navy, Gap, Banana Republic, and Athleta.

Gap’s recent fourth-quarter performance came in ahead of expectations on both its top-line and bottom-line fronts. Revenue increased 2.3% year-over-year to $4.53 billion, outperforming estimates by $32.4 million. Net loss per share at $0.02, was much narrower than the Street’s consensus by $0.12. Comparable sales for the company were 3% higher as compared to the year-ago period.

Management noted that after two years of restructuring, the company’s core business is strong, and it is in a position of balanced growth across its brands. Notably, online sales, making up 43% of the company’s total business, jumped 44% as compared to Q4 2019.

With these developments in mind, let us take a look at the changes in Gap’s key risk factors that investors should know.

Risk Factors

According to the TipRanks Risk Factors tool, Gap’s top risk category is Macro & Political, contributing 7 of the total 27 risks identified for the stock, compared to a sector average of 4 risk factors under the same category.

However, in its recent report, the company has added one key risk factor under the Finance & Corporate risk category.

Gap highlighted that its success partially hinges on its ability to increase sales and drive margins. Comparable sales and margins are affected by a range of factors including apparel trends, competition, economic backdrop, merchandise releases, promotions, product mix, supply chain, and weather conditions.

As a consequence, the company sees fluctuations in its comparable sales and margins from historical periods as well as market expectations. These fluctuations or a failure to attain expectations of the market could impact Gap’s share price, credit ratings as well as liquidity.

Hedge Fund Activity

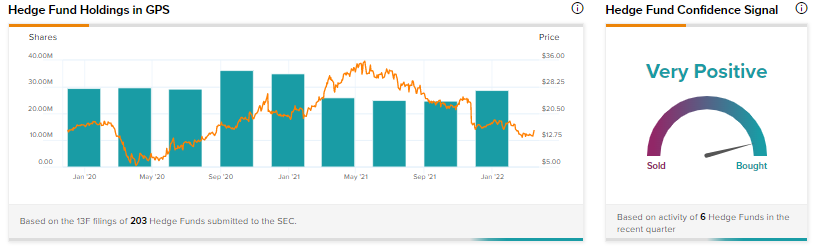

According to TipRanks data, Wall Street’s top hedge funds have increased holdings in Gap by 4.1 million shares in the last quarter, indicating a very positive hedge fund confidence signal in the stock based on activities of six hedge funds.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Intel to Invest €80B to Expand Footprint in European Union

Walmart Plans to Expand Technology Unit, Hire 5,000 Professionals

Nuvei Partners with Ledger to Increase Crypto Accessibility