GameStop Corp. (GME), an American video game, consumer electronics, and gaming merchandise retailer, has reported a wider-than-expected loss for the third quarter of Fiscal 2021 (ended October 2021).

Following the results, shares of the company lost 3.3% in the extended trading session on Wednesday after closing 2.3% lower on the day.

Results in Detail

The company reported a loss of $1.39 per share versus the consensus loss estimate of $0.52 per share. It reported a loss of $0.29 per share in the same quarter last year.

Meanwhile, net sales of $1.3 billion surpassed the Street’s estimate of $1.19 billion and rose 30% year-over-year. Sales generated through new and expanded brand relationships, including Samsung, LG, Razer, Vizio, among others, acted as tailwinds in the quarter.

Hardware and accessories sales were $669.9 million, up 62% year-over-year. Additionally, collectibles sales grew 30.8% to $192.2 million, while software sales declined 2.2% to $434.5 million. (See GameStop stock charts on TipRanks)

At the end of the third quarter, inventory stood at $1.14 billion, higher than the $861 million recorded at the end of the same quarter last year. The higher amount reflected the company’s focus on front-loading inventory investments to cater to increased customer demand and ease supply chain issues.

As of October 31, 2021, the company’s cash and cash equivalents stood at $1.41 billion.

CEO Comments

During the earnings call this week, the CEO of GameStop, Matt Furlong, said, “We continue to see a customer-first culture taking hold throughout our stores, fulfillment centers and corporate offices. Maintaining this emphasis on the customer will remain key as we work to grow across categories and new areas.”

“During the quarter, we focused on expanding our selection, accelerating delivery speeds and improving the customer experience. We also made long-term investments in our infrastructure, talent and technology. We believe our emphasis on the long term is positioning us to build what will ultimately become a much larger business, relative to where we are in 2021. We’ve also been exploring emerging opportunities in blockchain, NFTs and Web 3.0 gaming,” Furlong added.

See Insiders’ Hot Stocks on TipRanks >>

Wall Street’s Take

The stock has picked up a rating from one analyst in the past three months. Wedbush analyst Michael Pachter reiterated a Sell rating and a price target of $50 (71.2% downside potential).

Website Traffic

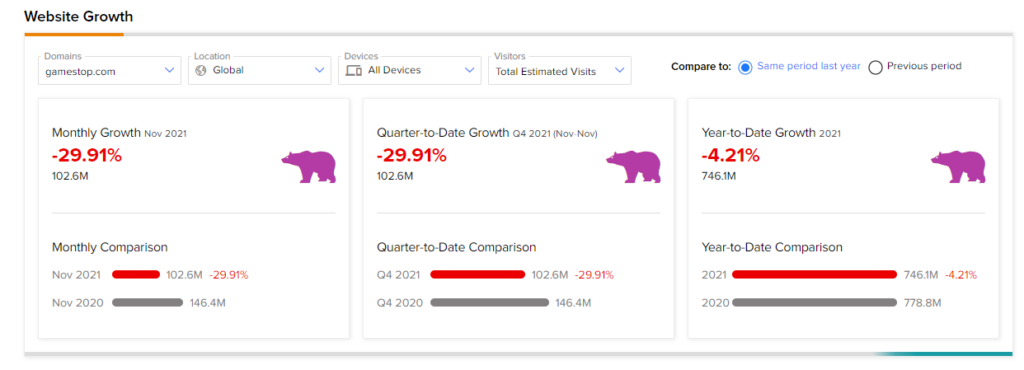

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into GameStop’s performance this quarter. According to the tool, the GameStop website recorded a 29.91% fall in global visits in November compared to the same period last year. Also, a quarter-to-date comparison showed a decrease of 29.91% compared to Q4 2020, and the year-to-date website traffic decline stands at 4.21%.

Related News:

ExxonMobil Targets Net Zero Emissions in Permian Basin by 2030

Stitch Fix: Q1 Results Top Estimates, Q2 Revenue Guidance Disappoints

ChargePoint Books Wider-than-Expected Q3 Loss; Shares Drop After-Hours