G-III Apparel Group reported better-than-expected 3Q results, thanks to its casual and comfortable product lines that bode well with consumer demand. Shares of the apparel company rose 2.3% in Tuesday’s extended trading.

G-III Apparel’s (GIII) 3Q revenues of $826.6 million surpassed analysts’ expectations of $768.2 million. Its earnings of $1.29 per share also beat the Street’s estimates of $0.77.

G-III’s CEO Morris Goldfarb said, “Our results reflect a significant sequential improvement in the third quarter as we effectively developed product lines that aligned with the shift in consumer demand towards casual, comfortable and functional clothing. We believe our product assortments for our portfolio of global brands are responsive to today’s market trends as we continue to gain market share.” (See GIII stock analysis on TipRanks)

For 4Q, G-III anticipates revenues to decline 30% from the year-ago quarter level. The company did not provide any additional guidance citing significant uncertainty related to the COVID-19 pandemic.

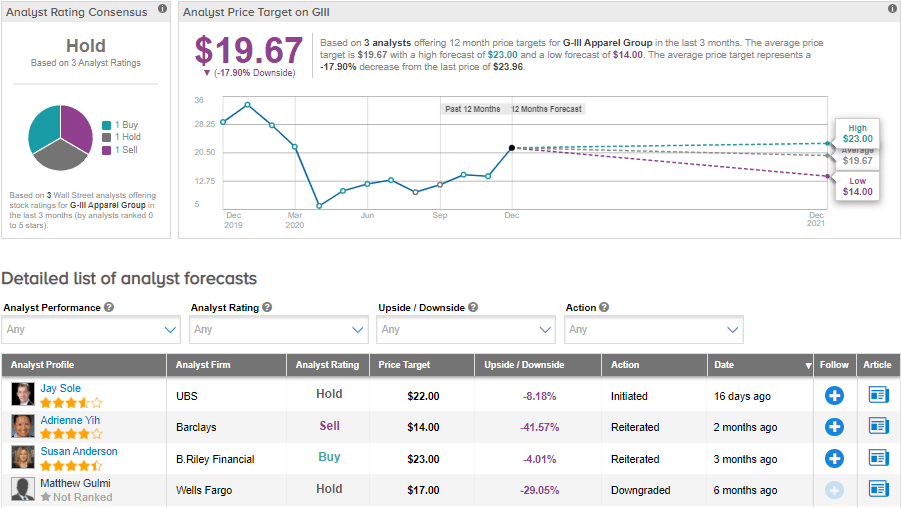

On Nov. 23, UBS analyst Jay Sole initiated coverage on G-III with a Hold rating and a price target of $22 (8.2% downside potential). In a note to investors, Sole pointed out that the company faces secular headwinds as a wholesaler despite operating two “strong brands.” The analyst also expects the price-to-earnings multiple of the stock to “remain at trough levels.”

Overall, the Street is sidelined on the stock. The Hold analyst consensus is based on 1 Hold, 1 Buy and 1 Sell. The average price target stands at $19.67 and implies downside potential of about 17.9% to current levels. Shares have dropped by 28.5% year-to-date.

Related News:

GameStop Sinks 17% As 3Q Sales Disappoint; Street Sees 54% Downside

Chewy Posts Lower-Than-Feared 3Q Loss; Stock Up 173% YTD

Casey’s Falls Despite 2Q Earnings Beat And Dividend Hike