FuboTV (FUBO) reported Q1 2022 results that showed a more than 100% year-over-year rise in revenue. However, FUBO stock crashed more than 10% on May 5, shortly after the results came out.

FuboTV operates a video streaming platform, which primarily serves up live sports programming, and is available in North America and some pockets of Europe.

Q1 Earnings Numbers

Revenue jumped 102% year-over-year to $242 million, but fell short of Wall Street’s expectation of $243.29 million. The adjusted loss per share of $0.69 widened from $0.41 loss per share in the same quarter the previous year and missed the consensus estimate of $0.65 loss per share.

Executive Chairman of FuboTV, Edgar Bronfman Jr., said, “While striving to be the most compelling destination for cord cutters, fuboTV has started to enact a series of approaches to increase monetization, accelerate our ad sales business, and further strengthen our unit economics.”

Q2 Outlook

In Q2, FuboTV anticipates North America revenue in the range of $220 million to $225 million and Rest of World (France and Spain) revenue of $5 million to $6 million. The company expects total revenue in the range of $225 million to $231 million, which even at the high end falls short of the consensus estimate of $244 million.

It seems the Q1 earnings miss and downbeat Q2 guidance disappointed investors. which led to a 10% drop in stock.

Wall Street’s Take

On May 4, ahead of the earnings report, Wedbush analyst Michael Pachter reiterated a Buy rating on FUBO stock with a price target of $15, which indicates 264% upside potential.

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating. That’s based on six Buys versus five Holds. The average FuboTV price target of $13.39 implies 225% upside potential to current levels. Shares have declined 88% over the past six months.

Blogger Opinions

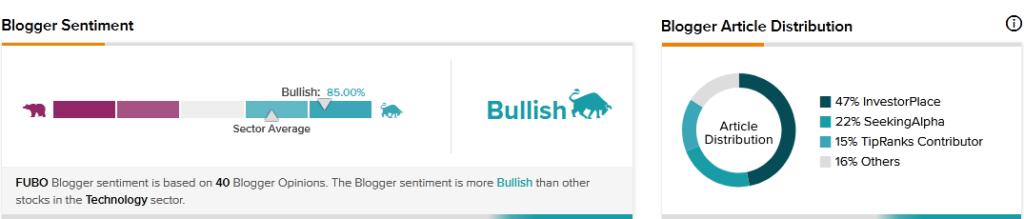

TipRanks data shows that financial blogger opinions are 85% Bullish on FUBO, compared to a sector average of 68%.

Key Takeaway for Investors

FuboTV faced multiple macro headwinds in Q1, with the management explaining that the pressure in the advertising market was greater than it had expected. These challenges are not unique to FuboTV since they are impacting industries across the board, and they should be temporary.

A major bright spot for FuboTV is that television viewing and advertising dollars continue to shift online, which should benefit its business for the long-term. While the financial results disappointed, FuboTV continued to add new subscribers in Q1. Furthermore, FuboTV’s strong balance sheet, comprised of $456 million in cash, offers the company the financial flexibility to pursue its opportunities.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Marriott Comforts Investors with Upbeat Q1 Results

Lockdown in China Leaves Yum! Brands With a Sour Taste

Ansys Delivers Robust Q1; Bolsters Electronics Portfolio