Shares of global investment management company Franklin Resources, Inc. (BEN) have gained 32.8% over the past 12 months. This week, BEN reported $1.58 trillion in Assets Under Management (AUM) at the end of December. In comparison, AUM stood at $1.55 trillion at the end of November.

The increase in AUM was driven by long-term net inflows, the O’Shaughnessy Asset Management (OSAM) acquisition, and favorable market impact.

With these developments in mind, let us take a look at the changes in BEN’s key risk factors that investors should know.

Risk Factors

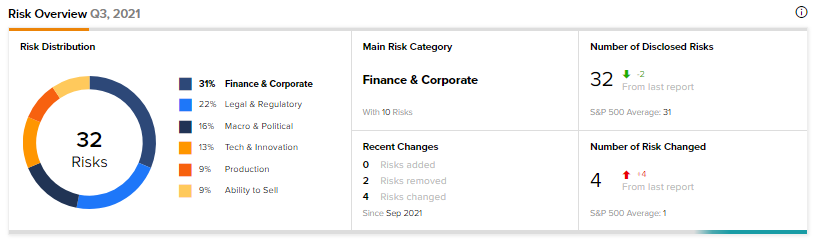

According to the TipRanks Risk Factors tool, Franklin Resources’ top risk category is Finance & Corporate, contributing 31% to the total 32 risks identified. In its recent annual report, the company has removed two key risk factors.

BEN had noted that it is subject to a substantial risk of asset volatility, stemming from changes in global financial, equity, debt, and commodity markets. Previously, changes in market prices, currency rates, and interest rates have led to lower AUM and lower fee revenue for the company, and this situation could occur in the future as well.

The company had also highlighted that the amount and mix of its AUM are subject to gyrations due to market conditions that are outside of BEN’s control. Any decrease in the value or amount of the company’s AUM due to factors such as asset outflows or stock volatility could negatively impact BEN’s revenue and income.

Meanwhile, compared to a sector average of 6%, BEN’s Ability to Sell risk factor is at 9%.

Blogger Opinions

TipRanks data shows that financial blogger opinions are 100% Bullish on Franklin Resources, compared to a sector average of 70%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

ExxonMobil Acquires 49.9% Interest in Biojet

Nio Enters Strategic Partnership with Baosteel; Street Says Buy

Apple Submits Plans for Third Party Payment Systems in App Store – Report