Foxconn (HNHPF), the world’s largest electronics maker, reported stronger-than-expected earnings for the third quarter. Profit rose 17% year-over-year to $1.89 billion, which was higher than the $1.65 billion analysts had forecast. The company said growth was mainly driven by demand for AI servers. In another potential development, Foxconn Chairman Young Liu has hinted at a possible collaboration with OpenAI (PC:OPAIQ), although no further details have emerged at this time.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

This is the second quarter in a row where Foxconn’s cloud and networking unit, which includes AI servers, brought in more revenue than its smartphone and consumer products unit. That part of the business consists of iPhone assembly for Apple (AAPL). According to the company, this shift signals a growing trend in how global tech firms are spending their capital.

Big names like Amazon (AMZN), Microsoft (MSFT), and Alphabet (GOOGL) (GOOG) are investing billions of dollars to expand their data centers and support the development of AI. As the top supplier of AI servers to Nvidia (NVDA), Foxconn is now benefiting from that demand.

Meanwhile, HNHPF shares dropped by 0.95% on Tuesday to close at $15.98.

2025 Outlook and OpenAI Partnership Hint

Looking ahead, Foxconn said it expects AI-related revenue to grow again in the fourth quarter. Management also kept its full-year outlook unchanged and called for a strong year-over-year increase in revenue. Although it does not publish exact forecasts, Foxconn pointed to a healthy pipeline in AI infrastructure orders.

Chairman Young Liu said the company is “very optimistic” about AI demand in 2025 and beyond. He believes that the sector will become a major driver of growth through 2026. At the same time, he noted the company remains cautious about currency risks and geopolitical pressures.

Foxconn also announced that it will hold a tech event next week in Taipei. Liu said the company will make an announcement related to OpenAI, the firm behind ChatGPT. He did not share further details. OpenAI has not commented yet.

Is Foxconn Stock a Buy?

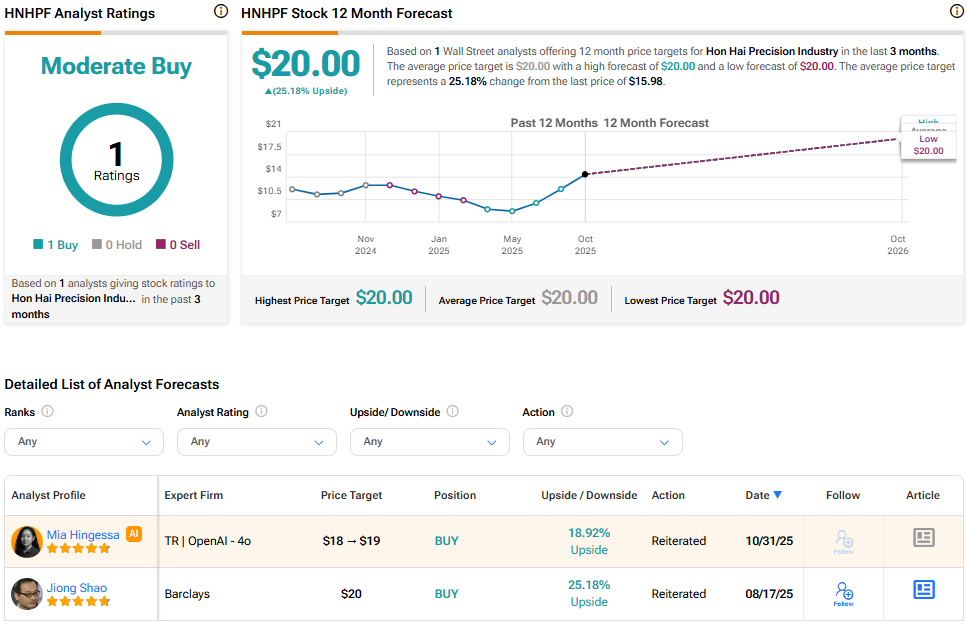

Foxconn is thinly followed by the Street’s analysts. Based on one rating, the stock boasts a Moderate Buy consensus. The average HNHPF stock price target is $20, implying a 25.18% upside from the current price.