Ford (F) has unveiled its global battery center of excellence called Ford Ion Park, an initiative that builds on decades of battery expertise and will accelerate the research and development of battery cell technology.

Ford has set up a team of 150 experts tasked with accelerating battery technology development, research, and manufacturing. The team is also tasked with exploring better integration and innovation opportunities across various value chains.

The team will focus on customer insights to come up with battery technologies that meet utility and commercial fleet owners’ desires. Anand Sankaran, a 30-year Ford veteran, is tasked with providing much-needed leadership for this initiative.

The unveiling of the Ford Ion Park comes as Ford ramps up the production of Electric Vehicles. Investing in the R&D of battery technologies should allow the automaker to come up with low-cost electric vehicles.

“We are modernizing Ford’s battery development and manufacturing capabilities so we can better control costs and production variables in-house and scale production around the world with speed and quality”, said Ford’s chief operations officer, Hau Thai-Tang.

Ford is also setting up a $185 million learning lab in Southeast Michigan to develop, test, and build vehicle battery cells. The learning lab will come with pilot-scale equipment that should allow the automaker to quickly scale breakthrough battery cell designs. (See Ford stock analysis on TipRanks).

Wolfe Research’s analyst, Rod Lache upgraded Ford to a Buy, reiterating the company’s clear path to improvement in 2022 and beyond.

“Ford will largely exit manufacturing in South America by the end of this year ($500 MM loss in 2020). We also expect Ford to largely eliminate losses in Europe ($800 MM loss in 2020). And we expect significant improvement in China (lost $500 MM in 2020)” said Lache.

The analyst increased his price target on the stock to $15 from $13, implying approximately 20% upside potential to current levels.

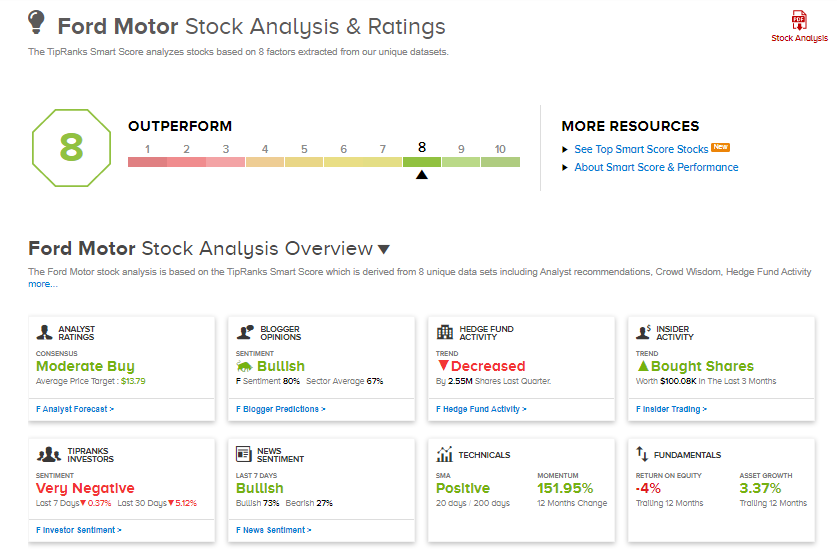

Wall Street is optimistic about Ford’s long-term prospects. Consensus among analysts is a Moderate Buy based on 8 Buys, 6 Holds, and 1 Sell. The average analyst price target of $13.79 implies 10.41% upside potential to current levels.

Ford scores an 8 out of 10 on the TipRanks’ Smart Score rating system, suggesting that it is likely to exceed market expectations.

Related News:

ADT Files Lawsuit Against Amazon’s Ring Service – Report

IBM Partners With HCL To Create A Unified Threat Management System

Lyft To Sell Autonomous Driving Division To Toyota For $550M – Report