Shares in Five Below (FIVE) surged 11% in Tuesday’s after-hours trading, despite the specialty value retailer posting a resounding earnings miss.

Specifically, Q1 Non-GAAP EPS of -$0.93 fell short of Street expectations by $0.63 while GAAP EPS of -$0.91 also missed by $0.61. Revenue plunged 45% year-over-year to $200.9M, which also came in $29.99M below Street estimates. Comparable sales decreased by 51.8% and net loss was $50.6M vs $25.7M in the first quarter of fiscal 2019.

During the quarter, FIVE opened 20 net new stores- bringing its total store count to 920- with roughly 90% of stores now reopened after closing on March 20 due to the Covid-19 pandemic.

Joel Anderson, FIVE CEO, stated, “The challenges of the last few months were unprecedented. We temporarily closed stores on March 20… [and] this decision had significant financial ramifications.” However, he did add: “We are very pleased with the initial sales trends we are seeing as stores reopen.”

Five Below did not provide sales or earnings guidance for Q2 or fiscal 2020- but it did reveal that it expects to open 100 to 120 net new stores in 2020.

“Unsurprisingly, 1Q comps declined (51.8%) as GM/SG&A took a hit from fixed cost deleverage due to the sales impact of store closures” commented RBC Capital’s Scot Ciccarelli post-print.

“While re-opened stores are comping +8% QTD, traffic trend questions will likely persist for the near/medium-term and social distancing requirements could pressure the high-volume holiday selling season” he wrote.

Nonetheless, the analyst says he remains a ‘buyer’ of FIVE as he took his price target from $102 to $115, citing the stock’s low price point offering and highly compelling economic model.

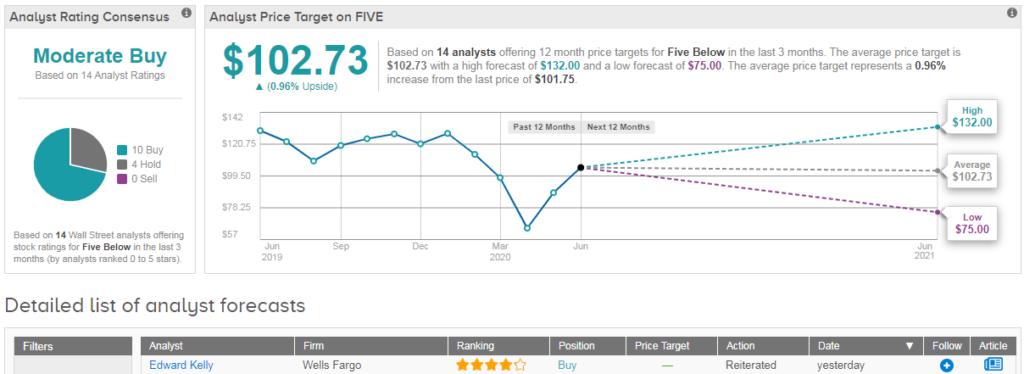

Overall, FIVE shows a cautiously optimistic Moderate Buy consensus with 10 recent buy ratings and 4 hold ratings. The average analyst price target stands in-line with the current share price at $103. Shares are currently trading down 19% year-to-date. (See FIVE stock analysis on TipRanks)

Related News:

GameStop Down 7% After-Hours As Earnings Fail To Impress

Lululemon Earnings Preview: Will LULU Live Up To The Hype?

Apple Seeks To Boost Sales Via Mac Trade-Ins, Payment Plans- Report