Shares of Fisker Inc. (FSR) spiked 3.9% to close at $12.98 on May 26 after the EV manufacturer announced its partnership with Mekonomen group, the spare-part chain in the Nordic region. Per the terms of the Letter of Intent (LOI), Mekonomen will provide after-sales services for Fisker cars across Denmark, Norway, and Sweden.

The Mekonomen Group will provide outsourced solutions including vehicle delivery, service and maintenance, fleet management, mobile fleet servicing, and refurbishment. Working through a network of over 3,000 workshops across Scandinavia, the Mekonomen Group will also cater services including driveway and remote service support, along with automotive parts logistics.

In addition to the recent collaboration, Fisker has formed strategic partnerships with Cox Automotive and Rivus Fleet Solutions in the U.K.

Fisker CEO Henrik Fisker commented, “From November 17, 2022 we will start production and deliveries of the Fisker Ocean SUV, with Denmark, Norway and Sweden among the first European markets to launch. Supporting a great product must be an equally great ownership experience. Partnering with the recognized leader in service and logistics across Scandinavia will be an important part of delivering excellence to our customers.” (See Fisker stock analysis on TipRanks)

On May 18, Morgan Stanley analyst Adam Jonas reiterated a Buy rating and a price target of $40 (208.2% upside potential) on the stock.

Jonas commented that Fisker posted a lower-than-expected operating loss with a wider-than-expected cash position in Q1. Furthermore, the company just slightly changed its outlook and raised operating expenses forecast range by $30 million with capital expenditures guidance unchanged for the Fiscal Year 2021, the analyst added.

Additionally, he said that the Ocean target for the fourth quarter of 2022 was maintained “with confidence” by the management.

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating. That’s based on 5 Buys, 3 Holds, and 1 Sell. The average analyst price target of $25.25 implies 94.5% upside potential to current levels. Shares have increased 27% over the past year.

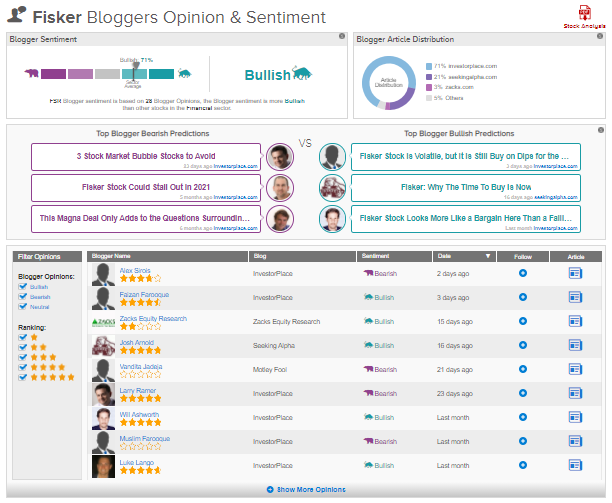

TipRanks data shows that financial blogger opinions are 71% Bullish on FSR, compared to a sector average of 69%.

Related News:

Cabot and Cimarex Ink All-Stock Merger Deal; Shares Fall

Dick’s Sporting Goods Quarterly Sales Pop 119%; Shares Gain Pre-Market

BioMarin Gets EMA Permit for Accelerated Assessment of Valoctocogene Roxaparvovec