First Hawaiian, Inc. (FHB) reported stronger-than-expected Q2 earnings, topping analysts’ estimates driven by a rebound in tourism and the local economy. Shares of the Hawaii-based bank holding company gained 2.32% on July 23 to close at $27.79.

The company reported adjusted earnings of $0.68 per share, beating analysts’ expectations of $0.67 per share. Notably, earnings per share jumped 54.5% from $0.44 per share reported in the prior quarter. (See FHB stock charts on TipRanks)

First Hawaiian CEO Bob Harrison commented, “We had good activity in the loan portfolio, solid growth in fee income and credit quality remained excellent. In addition, we benefitted from the improved outlook for the local economy with the release of $35 million from our reserves for credit losses.”

Net interest income came in at $131.5 million, up 1.8% sequentially while non-interest income grew $5.5 million to $49.4 million. Net interest margin was 2.46% in the quarter, down 9 bps sequentially and 12 basis points from the year-ago period.

The provision for credit losses was a benefit of $35 million in the quarter, while non-interest expenses were up $3.1 million to $99.4 million compared to the prior quarter.

The company reported gross loans and leases of $13.1 billion, down 1.5% from the prior quarter. However, total deposits surged 3.5% to $20.8 billion.

Following the Q2 results, Raymond James analyst David Feaster reiterated a Hold rating on the stock.

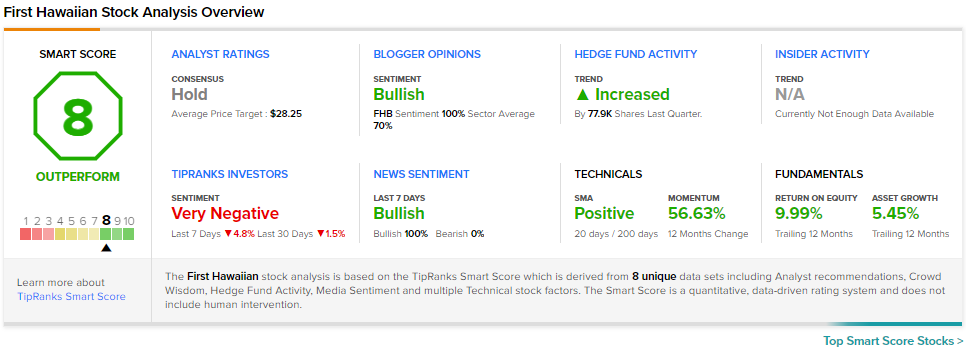

Consensus among analysts is a Hold based on 3 Holds and 1 Sell. The average First Hawaiian price target of $27.67 implies that shares are fully priced at current levels.

FHB scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Intuitive Surgical Posts Upbeat Q2 Results

Seagate Beats Q4 Estimates; Shares Drop 3.4%

Northern Trust Q2 Earnings Meet Expectations