Shares of FireEye jumped 16.7% in Thursday’s extended trading session after the cybersecurity solution provider revealed it received a capital investment from the Blackstone Group and announced the acquisition of Respond Software.

Blackstone Tactical Opportunities and ClearSky have bought $400 million worth of FireEye’s (FEYE) 4.5% Series A Convertible preferred stock at a price of $1,000 per share.

FireEye said that it “intends to use the proceeds to support strategic growth initiatives, including the acquisition of Respond Software announced today, as well as increased investment to accelerate the growth of the company’s cloud, platform and managed services portfolio.” The Series A preferred stock will be converted into the company’s common stock at a price of $18 per share.

Meanwhile, FireEye acquired Respond Software in a cash and stock transaction valued at $186 million. The company completed the transaction on Nov. 18. (See FEYE stock analysis on TipRanks)

FireEye noted, “The acquisition of Respond Software opens new market opportunities to deliver eXtended Detection and Response (XDR) capabilities to a broad set of customers. Additionally, it enables Mandiant® Solutions to further productize and scale its expertise and front-line intelligence as part of the Mandiant Advantage platform.”

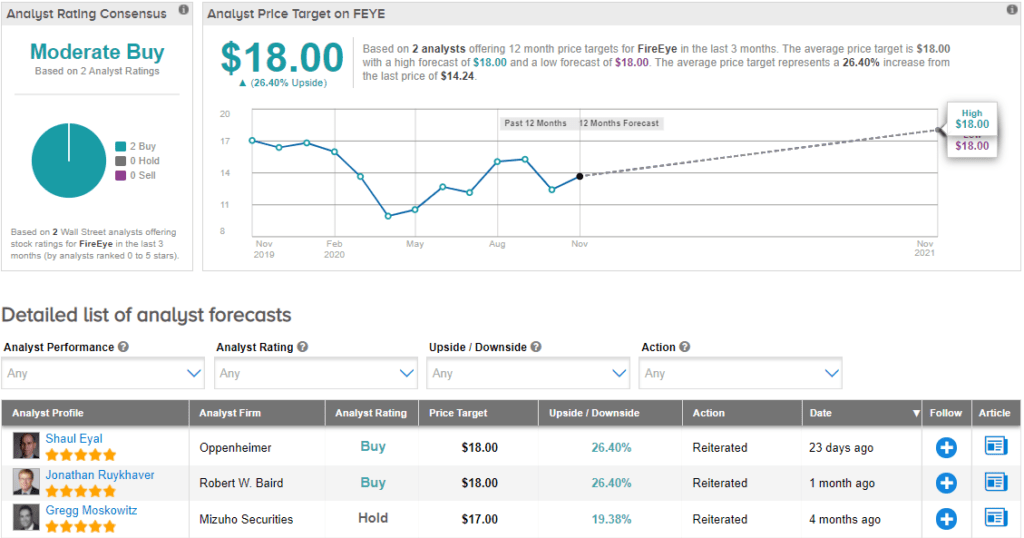

Following the announcements, Robert W. Baird analyst Jonathan Ruykhaver raised the stock’s price target to $20 (40.4% upside potential) from $18 and reiterated a Buy rating. In a note to investors, Ruykhaver wrote, “Overall, we see the investment from Blackstone as a positive sign and appreciate opportunity to incorporate Respond into the Mandiant Advantage platform. We continue to like FireEye and are positive on the moves the company has taken to shift the business toward its more strategic segments.”

Currently, the Street has a cautiously optimistic outlook on the stock with a Moderate Buy analyst consensus. The average price target stands at $18 and implies upside potential of about 26.4% from current levels. Shares are down by 13.9% year-to-date.

Related News:

Norbord Jumps 11% On West Fraser Takeover; Analyst Upgrades To Hold

NetEase Rises On 3Q Profit Win; Street Sees 25% Upside

Cubic Drops 4.5% As 4Q Sales Miss The Street