Fiat Chrysler Automobiles and Engie EPS have teamed up to form a joint venture in the first quarter of 2021, which will be focused on products and solutions for electric vehicles (EV) in Europe.

Under the terms of the Memorandum of Understanding, the joint venture would bring together Fiat Chrysler’s (FCAU) financial resources and industrial footprint and Engie’s technological know-how and intellectual property portfolio. The venture plans to offer a range of products, including residential, business and public charging infrastructures as well as green energy packages, for electric vehicle users to charge at home and at any public charging point across Europe with a fixed monthly subscription rate.

“The signing of this Memorandum of Understanding originates from a fruitful three-year cooperation between the two companies, which allowed the implementation of truly disruptive projects, such as the introduction of the exclusive FCA easyWallbox, an easy-to-use plug-and-play charging unit, the recently launched V2G Pilot Project and the innovative customer-oriented energy packages,” said Fiat Chrysler CEO Mike Manley. “The envisioned Joint Venture would allow an even higher commitment from both parties to expand the scope of the existing cooperation and further develop innovative products and services to enable and support a smooth shift to electric mobility in Europe.”

The new venture will be an Italian e-mobility technology company, with access to a portfolio of more than 100 patents, a team of electrical and system engineers, and an established automotive industrial footprint.

Shares of Fiat Chrysler have increased 12% over the past five days trimming this year’s decline to 1.5%.

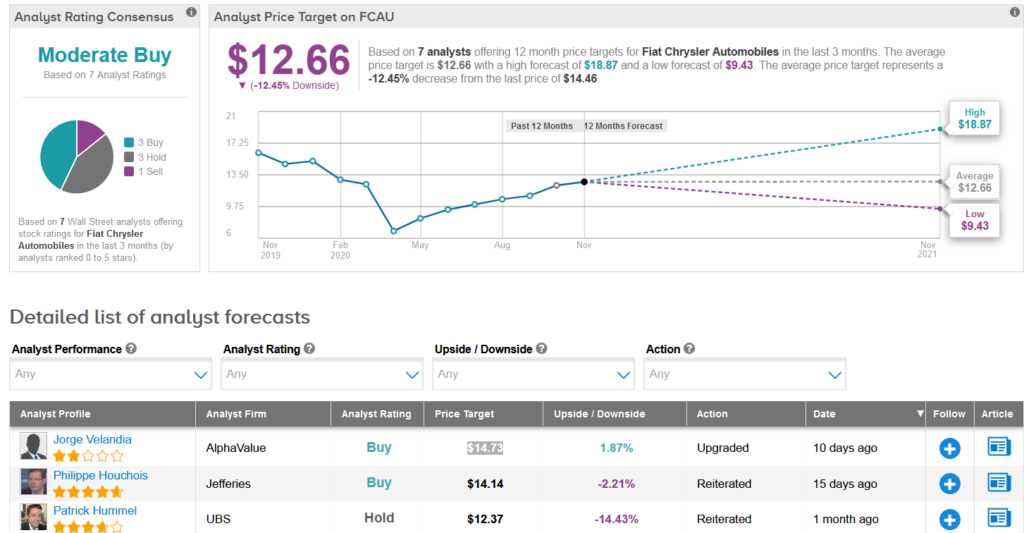

AlphaValue analyst Jorge Velandia recently upgraded Fiat Chrysler’s rating to Buy from Hold with a price target of $14.73, as the analyst projects strong demand for sport utility vehicles, which is expected to drive the company’s margin and cash growth.

Overall Wall Street analysts are cautiously optimistic about the stock. The Moderate Buy consensus breaks down into of 3 Buys, 3 Holds and 1 Sell. The average price target stands at $12.66, implying downside potential of more than 12% over the coming year.

Related News:

Airbus Inks Deal With Germany For 38 Eurofighter Typhoons; Street Sees 10% Downside

General Motors Embarks On Hiring Spree For EV Bonanza; Street Bullish

Nikola Says Partnership Talks With GM On Track; Shares Gain