The accelerated shift to e-commerce amid the COVID-19 pandemic not only benefited online retailers but also worked well for logistics and transportation companies like FedEx, UPS and XPO logistics. These companies took the opportunity to ramp up their capacities to try and meet the booming demand for shipping services, especially during the holiday season. Meanwhile, the pandemic-led disruption in economic activity had an adverse impact on the business-to-business segment of shipping companies, though volumes improved with the reopening of the economy.

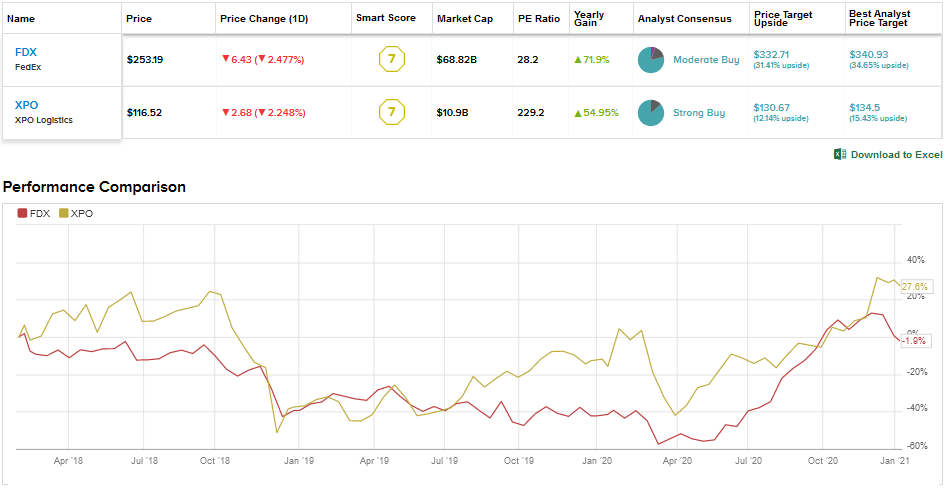

Bearing in mind improved business conditions and the rapid rise in e-commerce deliveries, we will use the TipRanks Stock Comparison tool to stack up FedEx against XPO Logistics and choose the stock, which offers more attractive investment opportunities.

FedEx Corp. (FDX)

FedEx, which has an extensive network in over 22 countries, recently reported strong results for the second quarter of fiscal 2021 (ended Nov. 30) backed by higher volumes in FedEx international priority business and U.S. domestic residential package services as well as increased pricing across all transportation segments. Notably, 2Q FY21 revenue grew 19% to $20.6 billion year-over-year and adjusted EPS jumped 92% to $4.83 during the same comparative period.

FedEx is benefiting from higher international volumes amid tight air cargo capacity as pandemic-led travel restrictions impacted the operations of commercial airlines. Looking ahead, the company expects continued strong demand for international priority shipments in 2021 as commercial air travel capacity remains constrained.

To meet the accelerated e-commerce demand, the company took various initiatives including, the expansion of FedEx Ground seven-day a week U.S. residential delivery service and investments in automated facilities as well as retail convenience networks. It also expanded Sunday residential delivery to about 95% of the U.S. population in September.

Furthermore, FedEx boosted its online commerce offerings with the acquisition of ShopRunner, an e-commerce platform that provides shipping, free returns and member-exclusive discount for more than 100 brands. (See FDX stock analysis on TipRanks)

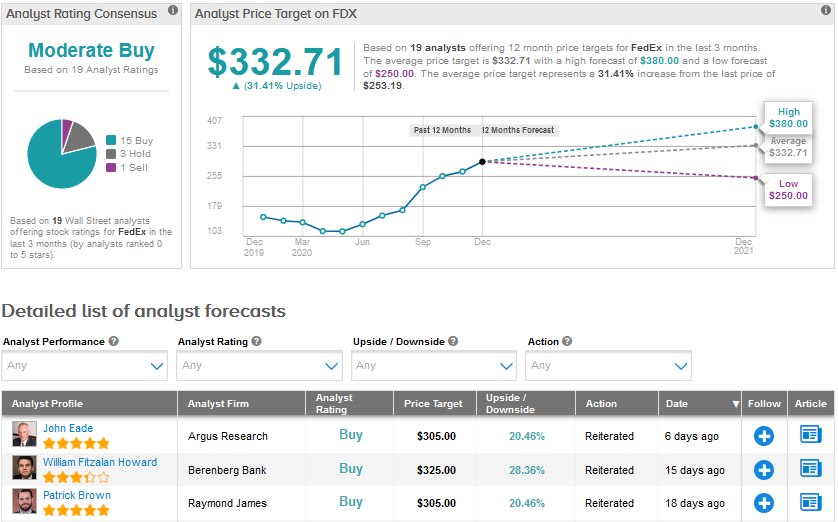

FedEx’s recent operational results prompted Raymond James analyst Patrick Brown to increase the stock’s price target to $305 from $280. Brown reiterated his Buy rating and stated “We continue to believe investments across the portfolio position FDX to reap future operational cost benefits (heightened capex + Ground/ Express “Last Mile Optimization”), synergies (TNT), and growth (seven- day Ground + last mile delivery at Freight).”

While the analyst is “cognizant of lingering macro risk”, he expects FedEx to benefit from “mounting tailwinds” in the residential parcel delivery business driven by e-commerce acceleration and favorable pricing landscape.

The rest of the Street has a cautiously optimistic outlook on the stock, with a Moderate Buy analyst consensus based on 15 Buys, 3 Holds and 1 Sell. Shares have gained an impressive 74.3% in 2020. What’s more, the average price target of $332.71 reflects an upside potential of an additional 31.4% from current levels.

XPO Logistics (XPO)

XPO Logistics is a global logistics providers of supply chain solutions, with operations in 30 countries. The company attracted investor attention in early December as it announced a plan to spin off its logistics business into a separate publicly-traded company in a tax-free transaction. The transaction would result in XPO shareholders owning shares in both companies.

XPO had first disclosed in January 2020 that it was exploring strategic alternatives, including the possible sale or spin-off of one or more of its business units. But the company had to cancel the strategic review in March due to the pandemic.

Following the most recent proposed spin-off, XPO will retain the transportation business, which includes less-than-truckload (or LTL) and truck brokerage transportation services. The LTL and truck brokerage services currently account for about 90% of the adjusted EBITDA generated by the company’s global transportation operations. The transportation business also includes the company’s last mile services (essentially for delivery of heavy goods), which benefited from the e-commerce boom amid the pandemic.

XPO management feels that its stock trades at a significant discount to its pure-play peers. The company believes that the spin-off will help create two pure-play businesses with distinct offerings and a lower debt profile with improved earnings potential. It expects to complete the spin-off in the second half of this year.

Wall Street analysts seem to have welcomed the company’s rationale for separation, with several investment houses boosting their price targets on the stock following the spin-off news. (See XPO stock analysis on TipRanks)

On Dec. 10, Cowen & Co. analyst Jason Seidl reiterated a Buy rating on XPO with a $148 price target as he argues that the company is an “underappreciated story” given its ability to navigate through the COVID-19 pandemic and strategic actions to improve its position in 2021. The analyst noted that in 3Q, North America LTL operations rebounded from a weak 2Q performance to deliver the best operating ratio in the company’s history.

“With core business metrics normalized and a favorable economic and consumer spending backdrop, we view XPO’s most recent initiative to structure a tax-free spin-off to create two separate publicly traded companies as evidence of management’s continued commitment to maximize shareholder value,” Seidl commented in a note to investors.

The analyst believes that beyond XPO’s core business operations, there are two unique trends to look out for – the company’s efforts to deleverage its balance sheet to move toward investment grade status and the adoption of emerging technology, mainly automation and robotics, to speed up warehouse activities and bring down labor costs.

The majority of analysts covering XPO are in line with Seidl’s bullish stance. The Strong Buy analyst consensus is backed by 13 Buys versus 2 Holds. The average price target stands at $130.67, implying upside potential of 12.1% in the year ahead. Shares have surged almost 50% last year.

Conclusion

The Street is optimistic about XPO’s long-term prospects and is confident that the proposed spin-off would boost the value of the separate entities. That said, investors looking for greater upside potential over the coming months would probably pick FedEx over XPO.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment