FedEx announced that it has completed the acquisition of e-commerce platform ShopRunner. The delivery giant announced the acquisition on Dec. 2. but didn’t disclose the financial terms of the transaction.

FedEx (FDX) said, “ShopRunner’s capabilities complement and expand the FedEx e-commerce portfolio and are expected to create increased value for brands, merchants and consumers.” According to FedEx, ShopRunner’s platform connects over 100 brands and merchants to consumers and offers online shopping and delivery services.

FedEx disclosed that the new acquired asset will become a subsidiary of FedEx Services. It will operate as part of the newly formed FedEx Dataworks division under the FedEx Services segment. (See FDX stock analysis on TipRanks).

“This is an exciting day for FedEx and ShopRunner, and it accelerates our ability to play a larger role in e-commerce,” said Raj Subramaniam, FedEx CEO. “We are thrilled to bring on ShopRunner’s team of highly-skilled professionals, product capabilities and existing customer base as we work together to create a better end-to-end e-commerce ecosystem for brands, merchants and online shoppers.”

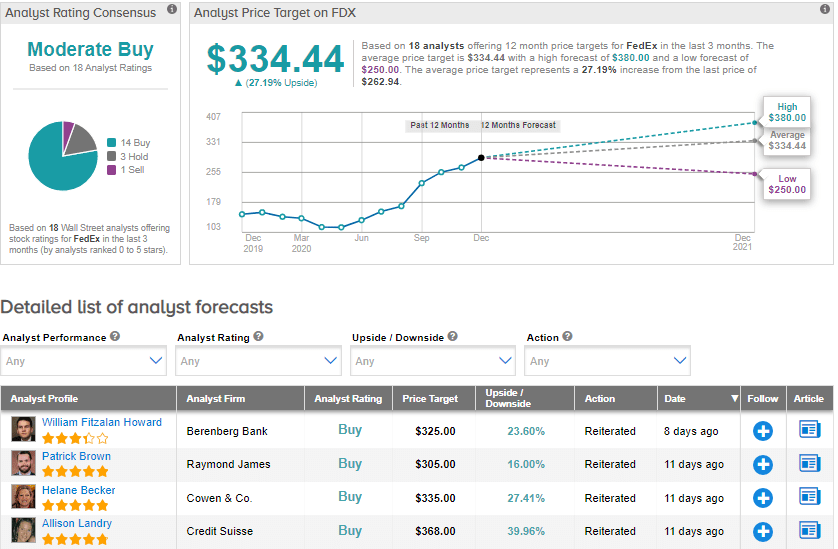

On Dec. 18, Raymond James analyst Patrick Brown raised the stock’s price target to $305 (16% upside potential) from $280 and reiterated a Buy rating.

In a note to investors, Brown wrote, “We continue to believe investments across the portfolio position FDX to reap future operational cost benefits (heightened capex + Ground/ Express “Last Mile Optimization”), synergies (TNT), and growth (seven- day Ground + last mile delivery at Freight). Moreover, while we are cognizant of lingering macro risk, we see mounting tailwinds in the residential parcel delivery complex anchored by a pronounced e-commerce acceleration and seemingly positively evolving pricing landscape.”

Consensus among analysts is a Moderate Buy based on 14 Buys, 3 Holds and 1 Sell. The average price target of $334.44 suggests upside potential of about 27.2% to current levels. FedEx stock has surged 73.9% year-to-date.

Related News:

FedEx Shares Fall 4% Despite 2Q Earnings Beat; Analysts Stay Bullish

United Therapeutics Buys Priority Review Voucher for $105M

Voya Wins Regulatory Nod To Divest Individual Life Business; Street Is Bullish