Shares of Fastly plunged 26.5% in Wednesday’s extended trading session after the cloud computing company trimmed its 3Q sales forecast. It now expects its 3Q revenues to be $70 million to $71 million, down from its earlier guidance range of $73.5 million to $75.5 million.

Fastly (FSLY) also stated that the August 5th outlook for 3Q and full-year 2020 should no longer be relied upon.

The reduced 3Q revenue outlook and full-year guidance withdrawal come after the company experienced lower-than-expected usage of its cloud services by its largest customer. During the 2Q conference call, Fastly had said that TikTok was its largest customer accounting for nearly 12% of its total revenues. (See FSLY stock analysis on TipRanks).

Additionally, Fastly blamed lower usage of its services by a few other customers during 3Q for the guidance modifications.

Following the 3Q update, Oppenheimer analyst Timothy Horan reiterated his Hold rating on the stock. In a note to investors, Horan wrote, “Instagram’s launch of Reels and political uncertainty likely drove eyeball time away from TikTok’s social media platform in 3Q20. FSLY also saw lower usage than expected from other customers toward the end of 3Q20. The company needed to have a perfect quarter to justify its current valuation.”

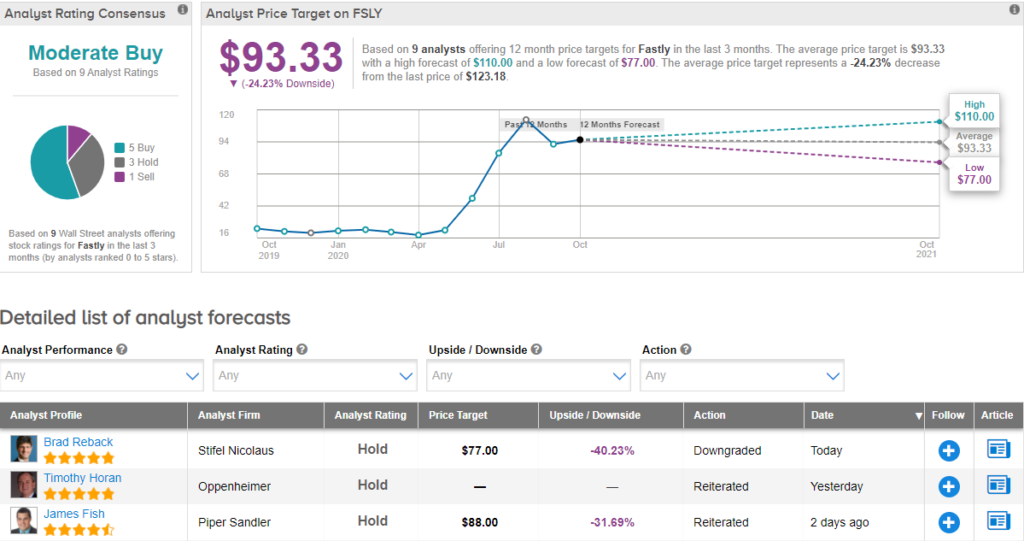

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 5 Buys, 3 Holds and 1 Sell. With shares up nearly 514% year-to-date, the average price target of $93.33 implies downside potential of 24.2%.

Related News:

GameStop Surges 8% On Hedge Fund Stake; Analyst Downgrades Stock

AMC Dips 6% Amid Cash Crunch Warning

Netflix Quietly Cancels Free US Trials In New Subscriber Push