Shares of Farfetch popped 18% in Thursday’s extended market session after the fashion retail platform’s sales surged 71% during the third quarter as pandemic-led restrictions pushed consumers to shop online for luxury goods.

In the three months to Sept. 30, Farfetch (FTCH) generated $438 million in sales, up from $255 million during the same period last year, and outperformed the $365 million expected by analysts. During the reported quarter, gross merchandise value (GMV) and digital platform GMV growth rates jumped 62% and 60% year-over-year, respectively, to record highs of $798 million and $674 million, respectively.

Meanwhile, the company posted a loss of $537 million, or $1.58 a share, in the third quarter, versus a loss of $90 million, or 30 cents per share, in the year-ago period. Farfetch lost 17 cents per share, compared with a loss of 20 cents per share a year ago. Analysts had forecasted an adjusted loss of 27 cents per share.

Farfetch is an online luxury fashion retail platform that sells products from boutiques and brands from around the world.

“What we are seeing is the acceleration of the secular trend of online adoption in luxury – an industry that is still very underpenetrated. The capabilities developed across the Farfetch platform over the past 13 years in anticipation of the eventual digitization of the luxury industry uniquely position Farfetch to capture this opportunity today,” said Farfetch CEO José Neves. “And our recently announced partnership with Alibaba and Richemont further position us to seize the opportunity to bring the luxury industry into the next generation and drive sustained growth and market share for many years to come.”

Looking ahead Farfetch CFO commented that “strong growth in revenue, steady improvement in unit economics and further operating cost efficiencies means we are another step closer to achieving the key milestone of operational profitability in the near-term.”

Indeed, for the fourth quarter, Farfetch expects digital platform GMV to be between $880 million and $910 million, reflecting growth of 40% to 45% year-on-year, while posting positive Ebitda.

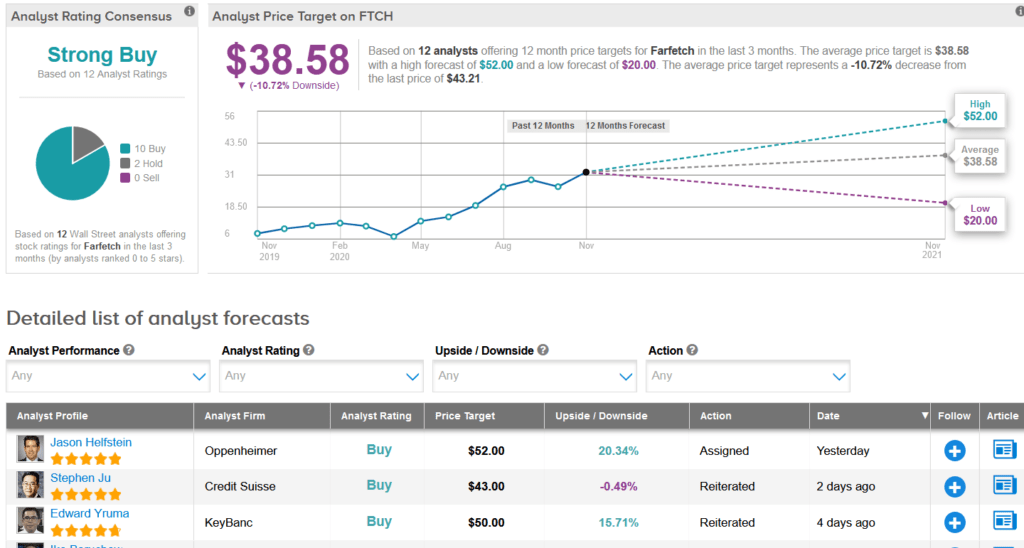

With shares exploding 317% this year, FTCH still scores a Strong Buy consensus from the Street with 10 Buys vs. 2 Holds. However, the average analyst price target now stands at $38.58, implying 11% downside potential over the coming year.

In a bullish note following the earnings results, Oppenheimer analyst Jason Helfstein bumped up the stock’s price target to a Street high of $52 from $32, citing higher peer valuations. Helfstein maintained a Buy rating as he believes that FTCH will continue to benefit from the pandemic-led accelerated secular shift to online channels.

“Separately, we are incrementally bullish on the China opportunity following the recently announced deal with BABA,” Helfstein wrote in a note to investors. “We believe Farfetch is well positioned with a first mover advantage to capture market share in the personal luxury fashion goods industry with an estimated tangible addressable market of $430B by 2025.” (See Farfetch stock analysis on TipRanks)

Related News:

Alibaba, Richemont To Invest $1.1B In Farfetch For China Push; Stock Up 323% YTD

General Motors Embarks On Hiring Spree For EV Bonanza; Street Bullish

Nikola Says Partnership Talks With GM On Track; Shares Gain