Facebook has closed its subsidiaries in Ireland, according to a report by the Times of London. The move came after the US Internal Revenue Service sued Facebook in February for shifting funds through its Irish holding companies to avoid US taxes.

In a statement to the Times, Facebook (FB) said “This change, which has been effective since July this year, best aligns corporate structure with where we expect to have most of our activities and people. We believe it is consistent with recent and upcoming tax law changes that policy makers are advocating for around the world.”

Facebook added, “Intellectual property licenses related to our international operations have been repatriated back to the U.S.”

Facebook used its Irish subsidiaries to hold intellectual property that had allowed it to shift billions of profits to the country where it was largely untaxed.

The British newspaper reported that Facebook’s Irish subsidiary paid $101 million in taxes and earned profit worth $15 billion in 2018. (See FB stock analysis on TipRanks)

Earlier this month, the Federal Trade Commission (FTC) and governments of 48 US states and territories filed antitrust lawsuits against Facebook targeting its two largest acquisitions – Instagram and WhatsApp. The lawsuit accuses Facebook of eliminating competition.

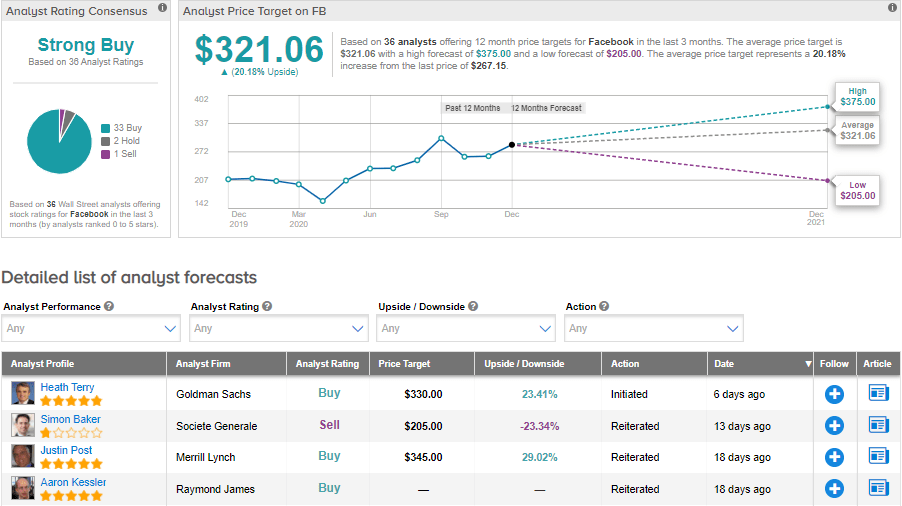

On Dec. 10, Merrill Lynch analyst Justin Post reiterated a Buy rating on the stock with a price target of $345 (29.1% upside potential).

In a note to investors, Post wrote that “For the time being we expect limited change to FB’s operations from the lawsuits, and do not see policy change with software developers as a big risk. However, the possibility of a breakup, even if slim, is noteworthy for Facebook and other social media companies. A breakup of Facebook could be concerning for investors given that separate Instagram and WhatsApp platforms would likely compete directly with Facebook for usage and advertisers, raising concerns on increased competition (and margins).”

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 33 Buys, 2 Holds and 1 Sell. The average price target stands at $321.06 and implies upside potential of about 20.2% to current levels. Shares have gained almost 30.3% year-to-date.

Related News:

Facebook Accuses Apple of Hurting Small Businesses – Report

Facebook Snaps Up Customer Service Start-Up Kustomer; Street Sees 17% Upside

Google Handed $25.5M Fine By Turkey For Abusing Market Dominance- Report