Facebook, Inc. (FB) hit 1 trillion market capitalization for the first time on June 29, when its share rose more than 4% after a U.S. District Judge dismissed two monopoly lawsuits against the social networking giant, calling them “legally insufficient.”

Shares closed down 1% at $351.89 on June 29, representing a market cap of $997.77 billion. (See Facebook stock chart on TipRanks)

The Federal Trade Commission (FTC) had filed an antitrust lawsuit last year, accusing FB of breaking the law by shutting out competition through the acquisition of rivals. Facebook had purchased Instagram (2012) for $1 billion and WhatsApp (2014) for $19 billion.

The judge said the FTC could not prove that FB had monopoly power in the social networking market, but also allowed the commission to refile a new lawsuit by July 29. The judge also dismissed a similar antitrust case filed by a coalition of U.S. states.

Meanwhile, Facebook CEO Mark Zuckerberg launched its newsletter product, Bulletin, yesterday. Bulletin is a platform to support independent writers who make a living by connecting directly with their readers in the U.S.

The Bulletin will provide complete editorial autonomy to writers to customize their standalone websites. Creators can choose their subscription models. These news articles will also be available on Facebook News and Facebook Pages.

Following the dismissal of the lawsuits, Bofa Securities analyst Justin Post lifted the price target of the stock to $400 (13.7% upside potential) from $390 while maintaining a Buy rating.

Post said, “We think the ruling suggests that it will be very difficult to break-up Facebook on the grounds that the acquisitions should not have been approved 7 and 9 years ago, and government’s cases will have to focus more on current marketplace share and behavior.”

The analyst added, “We view this dismissal as a positive step based on: 1) highlights the hurdles U.S. antitrust enforcers face in trying to break up tech companies, and 2) a noticeable change from continued negative regulatory news over the last year.”

However, he said, “Our experts have indicated that Congress and the EU could change laws to make the operating/antitrust environment more difficult for Facebook…so the regulatory battle is likely far from over. We consider the ruling a small win in a long battle.”

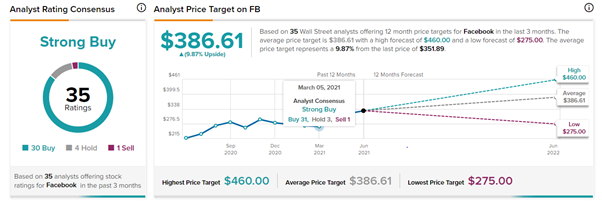

Based on 30 Buys, 4 Holds, and 1 Sell, the stock has a Strong Buy consensus rating. The average analyst Facebook price target of $386.61 implies a 9.9% upside potential from current levels. Shares gained 55% over the past year.

Related News:

AMC Theatres Record Blockbuster Weekend on Reopening; Shares Soar 7.5%

Morgan Stanley Doubles Quarterly Dividend; Increases Share Buyback to $12B

Beyond Meat Partnering with DoorDash; BYND Rises 5%