Facebook (FB) is scheduled to report first quarter 2021 earnings on April 28 after the market closes. Over the past year, shares of the social networking service company have jumped 49.8% and are currently trading at over $303. A strong print could push shares higher, so let’s take a closer look at what analysts on the Street are expecting.

Earnings Preview

Wall Street expects Facebook to report an EPS of $2.36 on revenues of $23.53 billion. Meanwhile, the Earnings Whisper number, or the Street’s unofficial view on earnings, stands at $2.68 per share.

Prior Period Results

In the previous quarter, the company reported earnings of $3.88 per share, up 52% from the same quarter in the previous year, and topped the consensus estimate of $3.23. Also, total revenue surged 33% to $28.1 billion and outpaced analysts’ expectations of $26.43 billion. (See Facebook stock analysis on TipRanks)

Factors To Watch For

The growing usage of Facebook’s services like Messenger, Instagram, and WhatsApp amid forced lockdowns and stay-at-home restrictions led to an increase in the company’s daily active users (DAUs). That increase in DAU’s is likely to have led to market share gains in the to-be-reported quarter. Notably, DAUs were 1.84 billion in the last quarter.

Furthermore, the coronavirus induced a major ongoing shift towards online commerce. That shift has driven gains for the ad business, which is likely to have continued in the first quarter of 2021. Therefore, Facebook’s top-line might have been pushed higher through growing usage of the platform and ad revenues.

Notably, Facebook’s CFO Dave Wehner commented in the 4Q earnings release, “In the first half of 2021, we will be lapping a period of growth that was negatively impacted by reduced advertising demand during the early stages of the pandemic. As a result, we expect year-over-year growth rates in total revenue to remain stable or modestly accelerate sequentially in the first and second quarters of 2021. In the second half of the year, we will lap periods of increasingly strong growth, which will significantly pressure year-over-year growth rates.”

Facebook’s initiative in providing a platform to small-and-medium businesses might have induced growth for the company in the first quarter. With the increasing demand for e-commerce services, that type of platform is in demand.

On the downside, a continued decline in price-per-ad impression and increasing competition remain. Additionally, the new iPhone update, iOS 14.5, is expected to increase difficulties for advertisers wanting to track people.

Nonetheless, Facebook’s innovative features, including a new shop tab and other tools on Instagram, are anticipated to fuel growth for the company in the coming period. With its continued investments in improving exposure in service areas, and its move towards usage of augmented reality glasses, Facebook is expected to flourish.

Meanwhile, a rise in expenses is expected to continue. Among Facebook’s bourgeoning expenses are investments in technology, products, and talent, as well as continued growth in infrastructure costs.

As indicated in January, Facebook expects its total expenses to be in the range of $68-73 billion in 2021. It estimates its CapEx to be in the range of $21-23 billion, driven by data centers, servers, network infrastructure, and office facilities. The impact of such costs might be reflected in the first quarter results as well.

Analyst Recommendations

On April 23, Monness analyst Brian White reiterated a Buy rating and a price target of $375 on the stock.

White said, “Despite some expected headwinds this year, we anticipate Facebook will benefit from improved ad spending and capitalize on accelerated digital transformation with new initiatives.”

The consensus rating among analysts is a Strong Buy based on 25 Buys versus 4 Holds. The average analyst price target stands at $348.92 and implies upside potential of more than 15% to current levels.

Bloggers Weigh In

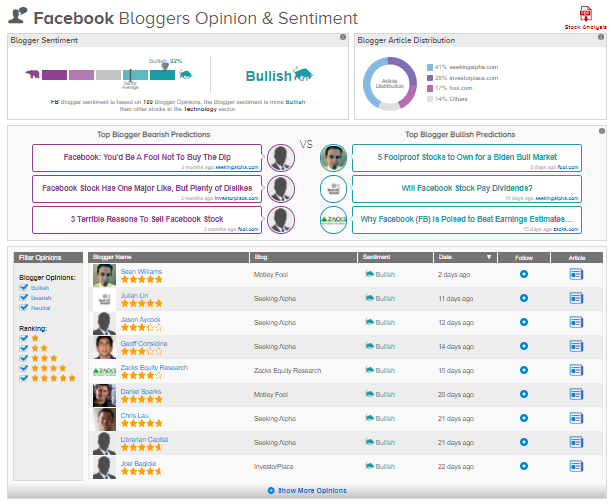

Additionally, TipRanks data shows that financial blogger opinions are 92% Bullish on FB, compared to a sector average of 66%.

Related News:

Amazon’s AWS Partners With DISH Network

Salesforce Aids Sonos In Digital Transformation

Lam Research’s 4Q Guidance Tops Estimates After 3Q Beat