A consortium headed by energy giant Exxon Mobil (NYSE:XOM) has submitted a development plan for its fifth oil production project in Guyana, per Reuters. The oilfield, called Uaru, is estimated to pump about 250,000 barrels of oil per day at peak levels.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The cost associated with the development of the fifth oilfield is $12.7 billion (as estimated by Guyana’s Environmental Protection Agency), which is 27% higher than the consortium’s fourth project. The consortium, which includes Hess Corp (HES) and CNOOC Ltd (DE:NC2B), has discovered about 11 billion barrels of oil and gas in the region.

The consortium plans to have six offshore projects in Guyana by 2027. According to Hess, the consortium aims to pump 1.2 million barrels of oil and gas per day by 2027 from all the developments, nearly three times last year’s peak production.

Guyana has evolved as the world’s fastest-growing oil nation since Exxon first discovered oil in the region in 2015. Exxon has made over 30 discoveries in the Stabroek block since 2015 and has ramped up offshore development and production in Guyana.

Exxon aims to double its earnings and cash flow potential by 2027 compared to 2019. The company intends to direct more than 70% of its planned capital expenditure through 2027 toward strategic developments in the U.S. Permian Basin, Guyana, Brazil, and global LNG projects. 2022 was a stellar year for Exxon as the company generated phenomenal profits due to elevated oil and gas prices triggered by the Ukraine-Russia war.

What is the Price Target for Exxon Stock?

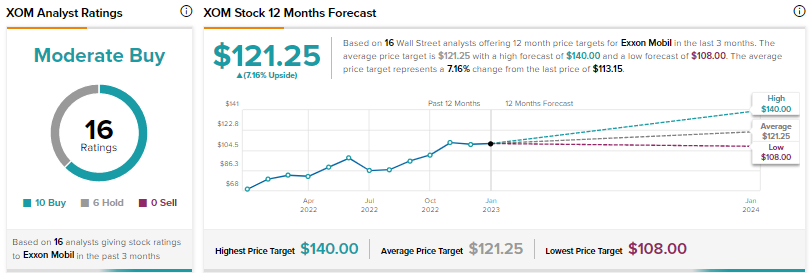

Wall Street’s Moderate Buy consensus rating for Exxon stock is based on 10 Buys and six Holds. The average XOM stock price target of $121.25 implies 7.2% upside potential. Shares have rallied nearly 61% over the past year.