Exxon Mobil (NYSE:XOM) is stepping out of the box and letting a highly competent outsider lead its low-carbon business unit to success. The oil & gas stalwart appointed Dan Ammann, the force behind General Motors’ (NYSE:GM) driverless-car unit, to head its new venture into climate-friendly business — Low Carbon Solutions.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The appointment of Ammann was an unusual move for the 140-year-old company, which has so far only hired fresh-out-of-school candidates and filled leadership positions internally.

Ammann is said to have been a strong contender for the position of GM’s chief executive officer, which later went to Mary Barra. This is his first time working for an oil company, and he is looking to approach his new responsibility with a “blank sheet of paper.” Ammann plans to run the new unit like a startup with vast resources and strong engineering capabilities.

With the help of the new business unit, Exxon Mobil aims to isolate up to 2 million metric tonnes of carbon dioxide per year from 2025 onwards, pumping the carbon underground at its property in Vermillion Parish. Last Wednesday, the Low Carbon Solutions unit witnessed its first deal under Ammann’s leadership. The agreement with leading ammonia producer CF Industries involves Exxon transporting and storing carbon dioxide at a Louisiana manufacturing facility belonging to CF.

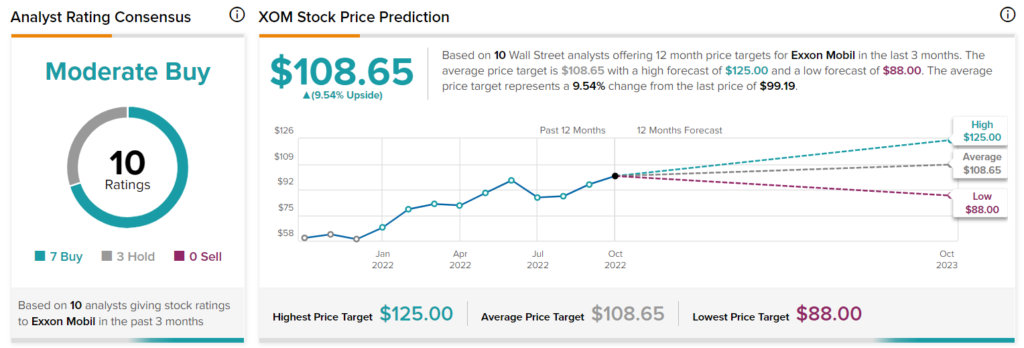

Is Exxon Mobil a Buy or Sell?

Wall Street is cautiously optimistic about Exxon stock, with a Moderate Buy rating based on seven Buys and three Holds. The average price target for XOM stock stands at $108.65 currently, indicating a 9.54% upside from the current price level.