Exxon Mobil (NYSE:XOM) is scheduled to report fourth-quarter 2022 earnings on January 31, before the market opens. The company’s bottom line is expected to have benefitted from higher natural gas prices during the quarter in comparison to the year-ago quarter.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Regarding Q4 estimates, the Street expects Exxon to post earnings of $3.29 per share, significantly higher than the $2.05 in the prior-year period. Meanwhile, revenue expectations are pegged at $97.3 billion, representing a year-over-year jump of 14.5%.

Energy prices soared in 2022 due to supply constraints caused by the war in Ukraine. Nevertheless, the recent fall in natural gas prices led to the pullback of Q4 estimates by the company.

Earlier in January, Exxon Mobil said that it expects lower natural gas prices to decline Q4 earnings by $2 billion to $2.4 billion, while lower crude oil prices are projected to have a negative impact of $1.3 billion to $1.7 billion.

Is XOM a Buy Stock?

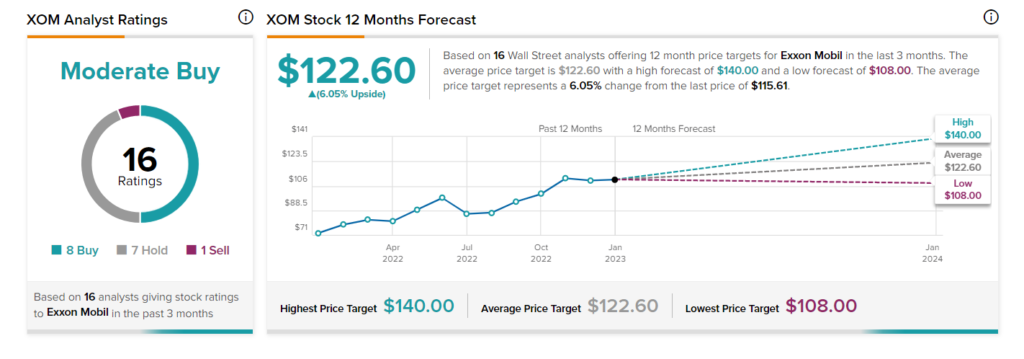

Wall Street is cautiously optimistic about XOM stock. The Moderate Buy consensus rating is based on eight Buys, seven Holds, and one Sell. The average stock price target of $122.60 suggests upside potential of 6.1% from current levels. Shares have gained about 24% in the past six months.