Exelon’s (EXC) ComEd has agreed to pay a $200 million fine as part of a settlement agreement to resolve a U.S. Justice Department probe into the unit’s long-running lobbying practices and bribery scheme in Illinois.

Under the three-year deferred prosecution agreement, ComEd has agreed to the U.S. government filing of a single charge that will be dismissed at the end of the three-year term, provided it abides by all terms of the agreement. The U.S. Attorney found that the electric utility between 2011 and 2019 “offered, and agreed to give jobs, vendor subcontracts, and monetary payments associated with those jobs and subcontracts, for the benefit” of a public official with the aim of influencing the official.

“We are committed to maintaining the highest standards of integrity and ethical behavior. In the past, some of ComEd’s lobbying practices and interactions with public officials did not live up to that commitment,” Exelon CEO Christopher Crane said. “We concluded from the investigation that a small number of senior ComEd employees and outside contractors orchestrated this misconduct, and they no longer work for the company.”

Crane added that the company has taken a number of steps to aggressively identify and address deficiencies, including enhancing its compliance governance and lobbying policies to prevent this type of conduct. It implemented four new mandatory policies for employees who interact with public officials, which lay out specific procedures and tracking mechanisms governing vetting and monitoring of lobbyists and political consultants. The policies also prohibit subcontracting of third-party lobbyists and political consultants.

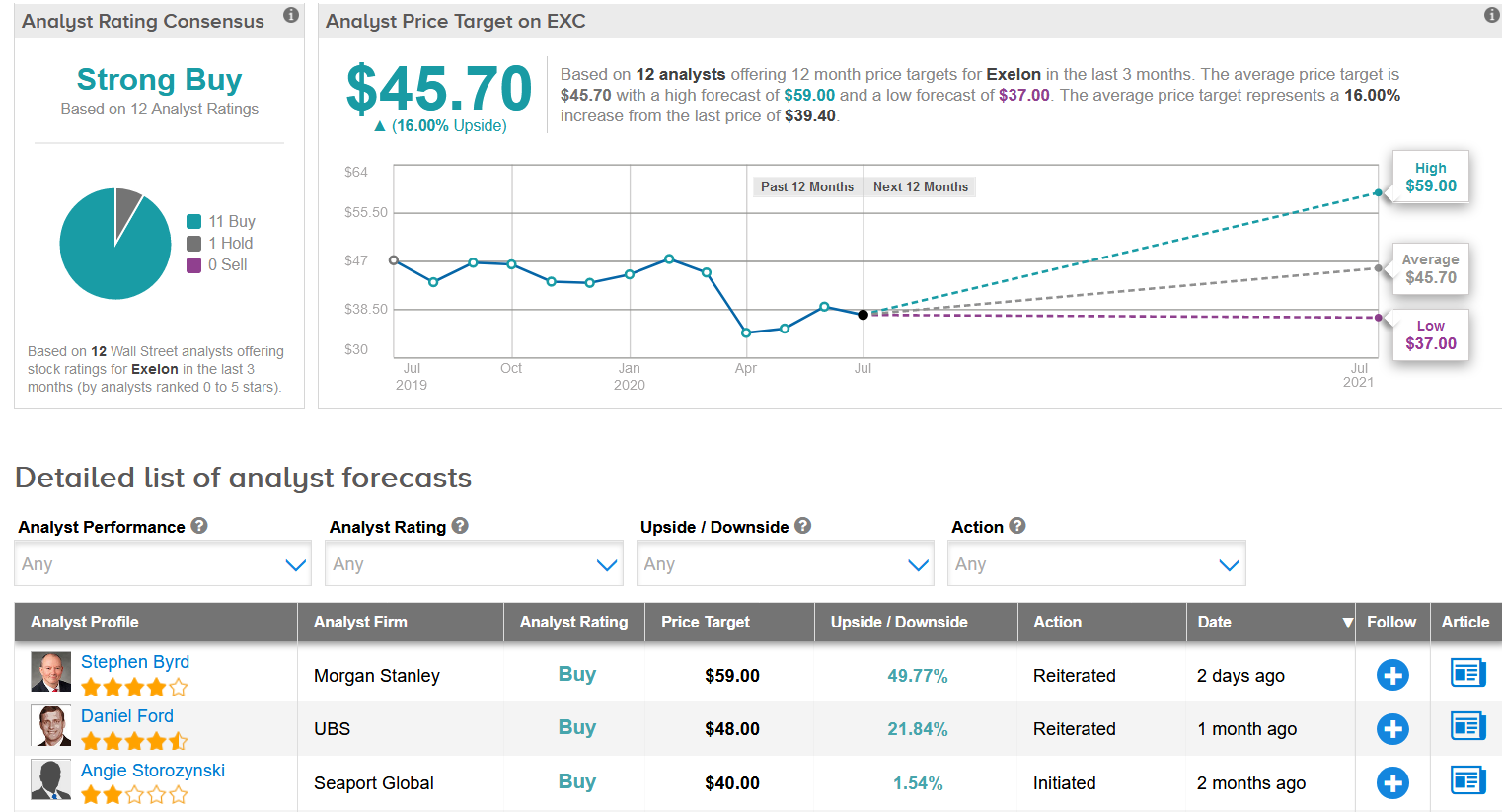

Following the settlement agreement, Exelon rose 3.5% to close at $39.40 on Friday. The stock has dropped 14% so far this year with the $45.70 average analyst price target suggesting shares have room to advance 16% over the coming year. (See Exelon stock analysis)

Overall, Wall Street analysts have a bullish outlook on the company. The Strong Buy consensus boasts 11 Buy ratings versus 1 Hold rating.

Related News:

National General Pops 69% In Pre-Market On $4B Takeover Deal By Allstate

Sunrun To Buy Vivint Solar For About $1.46B In All-Stock Deal

Billionaire Buffett’s Energy Unit To Buy Dominion Energy Assets For $4B