Exelixis’ partner Takeda Pharmaceutical has been granted approval by the Japanese Ministry of Health, Labor and Welfare for Cabometyx (cabozantinib) as a treatment for patients with unresectable hepatocellular carcinoma (or HCC) that has progressed after prior systemic therapy.

Exelixis (EXEL) shares rose 3.6% on Nov. 27 in reaction to the news, bringing the year-to-date increase to 10.4%.

Takeda received the approval based on the results of two clinical trials in patients with advanced HCC who had received prior systemic therapy. The two trials were Celestial (XL184-309), a global, randomized, placebo-controlled, double-blind phase 3 clinical trial, and Cabozantinib-2003, a phase 2 clinical trial conducted in Japan. The Celestial trial was the basis for the Cabometyx approvals in the US and the EU for the treatment of patients with HCC who have been previously treated with sorafenib.

Exelixis’ CEO Michael M. Morrissey stated, “Hepatocellular carcinoma causes approximately 30,000 deaths in Japan each year and is a leading cause of cancer-related death worldwide.”

“The approval of CABOMETYX in Japan is an exciting next step toward bringing this treatment to liver cancer patients who otherwise have limited treatment options following prior systemic therapy. We’re proud to collaborate with Takeda as we work to bring this treatment to patients in Japan,” added CEO Morrissey. (See EXEL stock analysis on TipRanks)

Under the collaboration and license agreement between the two companies, Exelixis is eligible to receive a $15 million milestone payment from Takeda upon the first commercial sale of Cabometyx for unresectable HCC, which is expected to occur in 4Q20.

Earlier this month, Needham analyst Chad Messer reiterated a Buy rating on Exelixis with a $33 price target following the company’s 3Q results. Messer noted, “Several pivotal readouts are expected into next year, starting with COSMIC-311 in DTC [differentiated thyroid cancer]. The 3 pivotal CONTACT studies of Cabo + Atezo have also begun enrollment. Exelixis highlighted recent progress in its early clinical pipeline, specifically with XL092. We believe future growth for the Cabo franchise will be driven by Cabo + IO combinations across treatment lines and indications.”

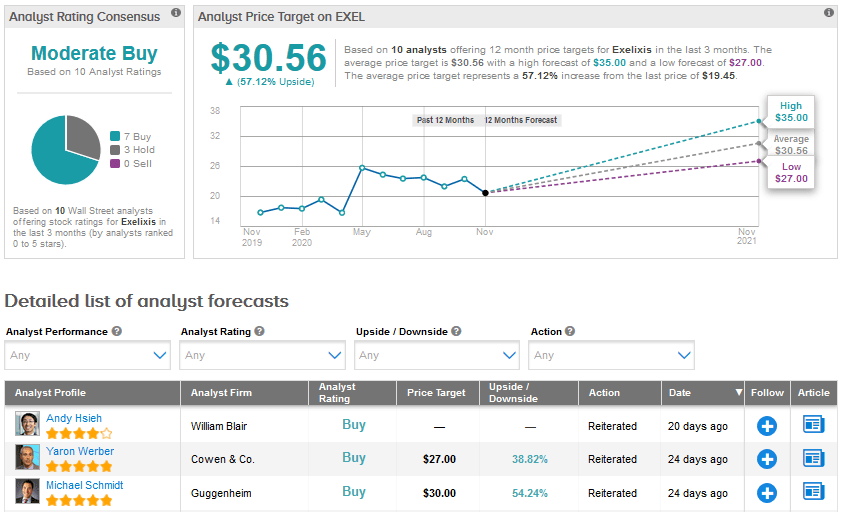

Overall, 7 Buys and 3 Holds add up to a Moderate Buy analyst consensus for Exelixis. The Street sees a strong 57.1% rise in the stock based on the average price target of $30.56.

Related News:

EC Approves Vertex’s Symkevi Combination Therapy For Cystic Fibrosis

FibroGen Gains Japanese Approval for Roxadustat; Mizuho Securities Sees 79% Upside

Rhythm Pharmaceuticals’ IMCIVREE Gets FDA Stamp of Approval; Stifel Boosts Price Target