Everi Holdings Inc. (EVRI) provides technology solutions to the casino gaming industry. The company has acquired certain strategic assets of the marketing platform XUVI.

Privately owned XUVI values, targets, and engages customers to boost loyalty via immersive analytics. While deal terms remained undisclosed, Everi funded the transaction with cash.

Management Weighs In

Darren Simmons, Executive Vice President and FinTech Business Leader at Everi, commented, “The combination of XUVI’s technology with our existing innovative loyalty solutions and marketing services will further strengthen our ability to provide customers with actionable information to enhance their patrons’ gaming experience and drive revenue growth.”

XUVI’s technology solution, BEAMSTUDIO, brings together a customer’s historical and behavioral propensity data and assigns a future value on the basis of their characteristics and behaviors.

The platform offers real-time predictive and actionable insights, which optimize marketing efforts and increase efficiencies.

Recent Positives

Additionally, Everi also partnered with Scarlet Pearl Casino resort this week to provide patrons the ability to convert cryptocurrency into cash. Moreover, the company also expanded its footprint to the Ontario iGaming market with a supplier license from the Alcohol and Gaming Commission of Ontario.

The company has been expanding its presence across key markets in the U.S. and Canada over the past three years.

Wall Street’s Take

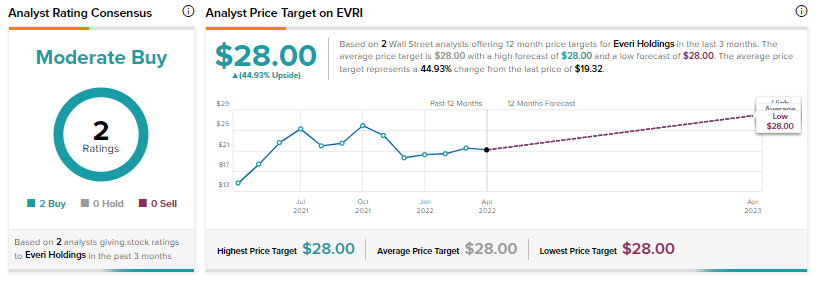

Roth Capital analyst Ed Engel has initiated coverage on the stock with a Buy rating and a price target of $28. The analyst believes the market has overlooked Everi’s demand outlook, growth prospects from its FinTech vertical, and free cash flow generating capabilities.

Overall, the Street has a Moderate Buy consensus rating on the stock based on two unanimous Buys. The average Everi Holdings price target of $28 implies a potential upside of about 44.93%.

Closing Note

The potential upside in the stock is on top of the 34% price appreciation delivered by the stock over the past 12 months. The combination of a rapidly expanding presence and innovative technological offerings from Everi provides a compelling case for investors.

The offering to convert cryptocurrencies into cash for casino customers may just be the icing on the cake for this one.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

BlackRock Posts Mixed Q1 Results; Analysts Say Buy

Why Did Myovant Sciences Close in the Red on Tuesday?

How Does American Airlines Expect to Perform in Q1?