Tech giant Microsoft (NASDAQ:MSFT) could face an antitrust investigation by European Union (EU) regulators in matters related to a case filed by workplace messaging app Slack (now owned by Salesforce (CRM), per a Reuters report.

In a complaint filed with the European Commission in July 2020, Slack alleged that Microsoft “illegally” bundled its Teams product with the highly popular Office productivity suite, thus forcing its installation by millions of enterprise customers. Microsoft launched its business communication platform Teams in 2017.

Last month, the European Commission reportedly sent out another set of questionnaires in a follow-up to the first batch of questionnaires that were sent in October 2021 to Microsoft’s rivals. The questionnaires asked rivals whether the bundling of products by Microsoft makes it more difficult to compete and other aspects like switching costs for customers.

The European Commission is now seeking further details about Microsoft’s interoperability and bundling and “preparing the ground for an investigation,” said people familiar with the matter. According to Reuters, Microsoft has been fined 2.2 billion euros for cases related to the bundling of products and other anti-competitive practices. It is currently facing an EU antitrust probe over the $69 billion potential acquisition of gaming company Activision Blizzard (ATVI).

Is Microsoft a Buy Now?

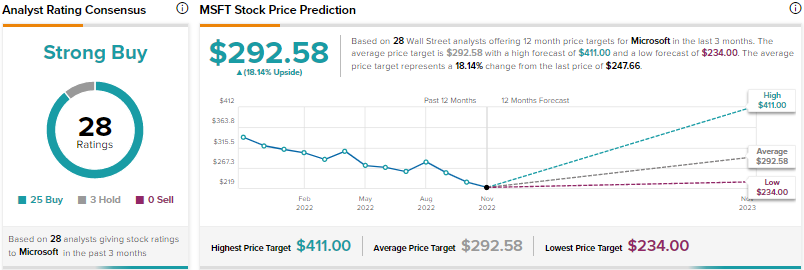

Microsoft stock scores Wall Street’s Strong Buy consensus rating based on 25 Buys and three Holds. The average MSFT stock price target of $292.58 implies 18.1% upside potential. Shares are down nearly 26% year-to-date. MSFT stock is currently trading at a P/E of 26.7, which is 15% lower than its five-year average.