Empire (TSE: EMP.A), the owner of grocery chains Sobeys, Safeway, FreshCo, and IGA, reported higher sales and profit in the third quarter than in a year earlier, boosted by higher fuel sales.

Sales & Earnings

Sales came in at C$7.38 million for the quarter ended January 29, 2022, an increase of 5.1% from the prior-year quarter. Same-store sales excluding fuel decreased by 1.7%.

The sales increase is primarily due to the acquisition of Longo’s, higher fuel sales, increased food inflation and the benefits of Project Horizon initiatives, including the expansion of FreshCo in Western Canada and Farm Boy in Ontario.

The increase was partially offset by changes in consumer buying behavior related to various measures related to COVID-19.

Net income for Q3 2022 amounted to C$203.4 million (C$0.77 per share), up from C$176.3 million (C$0.66 per share) in the same quarter a year ago.

Earnings continued to be positively impacted by strategic initiatives, including the continued expansion and renovation of the store network, strategic sourcing efficiency, promotion optimization and data analytics.

CEO Commentary

Empire president and CEO Michael Medline said, “Our team delivered another outstanding quarter, including the highest EPS in memory, with strong increases in sales, EBITDA margin and free cash flow. When you look at these results against the backdrop of the extremely volatile economic and retail environment, the strength of our team shines through. We are on track to deliver our Project Horizon targets next year, but the benefits don’t stop there. Material Project Horizon value will continue to be earned in fiscal 2024 and beyond.”

Outlook

Management continues to expect Empire to meet its three-year Project Horizon targets. The company expects that due to the significant positive sales impacts related to COVID-19 in fiscal 2021, comparable store sales growth rates in fiscal 2022 are expected to be negative and net income to be higher than the prior year.

Wall Street’s Take

Last week, RBC Capital analyst Peter Sklar kept a Hold rating on EMP.A with a C$41 price target. This implies 7.2% downside potential.

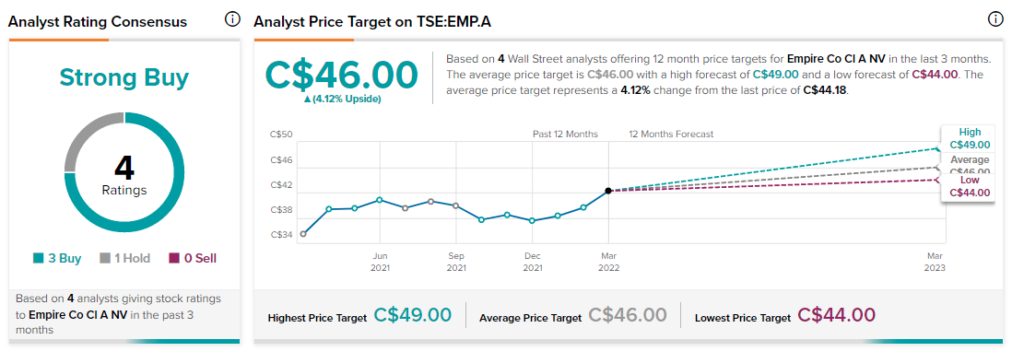

Consensus among analysts is that EMP.A is a Strong Buy based on three Buys and one Hold. The average Empire Co price target of C$46 implies 4.1% upside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Related News:

Maple Leaf Foods Q4 Profit Falls; Shares Plunge