Emergent BioSolutions Inc. (EBS) said on Thursday that it will invest $75 million in its Massachusetts facility to boost the contract development and manufacturing (CDMO) capabilities of drug substances for live viral vaccines.

As part of the investment, the life sciences company will acquire a property adjacent to its Massachusetts viral drug substance manufacturing site to build out its advanced therapy capability. Through the strategic facility acquisition, Emergent seeks to secure the long-term supply chain of the only single-dose smallpox vaccine.

The company said it expects advanced therapy CDMO drug substance manufacturing services to be available beginning in 2023.

“Emergent’s expansion into advanced therapy CDMO services is based on our biologics expertise and a strong understanding of our customers’ current and future needs,” said Emergent’s EVP of manufacturing and technical operations Sean Kirk. “We are investing in our people, plants, and products to meet the growing demand for precision treatments and to help get these therapies to patients.”

The company plans to provide full molecule-to-market CDMO services for viral vector and gene therapy innovators, by offering development services out of its Gaithersburg location, drug substance manufacturing out of its Massachusetts, and drug product manufacturing at its Rockville location.

Emergent’s CDMO business has the capability to work with five technology platforms – mammalian, microbial, live viral, advanced therapy, and plasma – across a network of nine development and manufacturing sites, to support the entire drug development life cycle.

The investment comes after last week’s announcement that Emergent signed an agreement to manufacture AstraZeneca Plc’s (AZN) potential COVID-19 vaccine in the U.S. in a deal valued at $87 million.

Shares in Emergent rose 1.8% to $71.18 in pre-market trading. The stock has advanced some 30% so far this year.

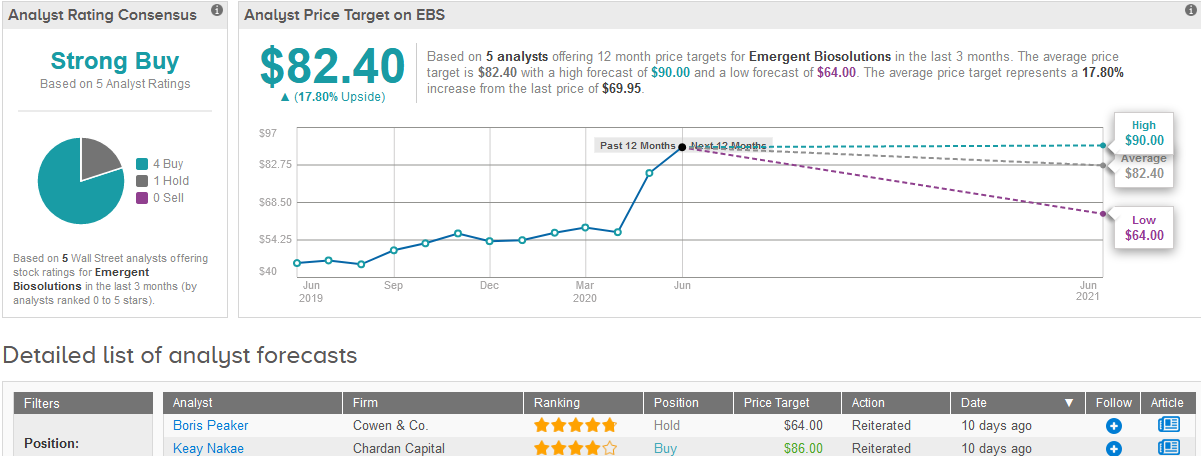

Earlier this month five-star analyst Boris Peaker at Cowen & Co. lowered the stock’s price target to $64 from $77 and maintained a Hold rating.

“We view EBS as the leading biodefense contractor, driven by sales of BioThrax and other biodefense product and services offerings,” Peaker wrote in a note to investors. “However, follow-on U.S. government contracts were smaller than anticipated, creating an impetus to diversify revenue.”

The rest of the Street has a bullish outlook on the stock. The Strong Buy analyst consensus boasts 4 Buy ratings versus Peaker’s Hold rating. Meanwhile, the $82.40 average analyst price target implies another 18% upside potential for the shares in the next 12 months. (See EBS stock analysis on TipRanks).

Related News:

Oxford Biomedica Clinches Manufacturing Deal For AstraZeneca’s Covid-19 Vaccine

5 Promising Covid-19 Vaccines Picked For Trump’s Operation Warp Speed

What Would a Merger Mean for Gilead? Top Analyst Weighs In