On July 11, Twitter (TWTR) shares fell more than 11%, extending their decline that began July 8 after Elon Musk changed his mind on buying the social media company. The stock dropped further after Musk mocked Twitter’s threat to force him to complete the deal. Musk’s strong response appeared to diminish Twitter investors’ hopes of the transaction closing. At $32.65, Twitter shares have declined about 23% year-to-date and dropped almost 40% from Musk’s $54.20 buyout offer price.

After more than a week’s break from social media, Musk resurfaced on Twitter with a photo of him and his kids with the pope. It seemed like the billionaire Tesla (TSLA) CEO had secured the pontiff’s blessings to buy Twitter. However, in a stunning twist, Musk said that he no longer wanted to proceed with the Twitter buyout. He blamed Twitter for causing him to abandon the deal, saying that the social media company breached their agreement.

Musk Hits Back After Twitter Threatens Legal Action

Twitter swiftly rejected Musk’s claims, describing the billionaire’s attempt to terminate the buyout deal as an invalid move. The company has hired lawyers to help it sue Musk in a bid to prevent him from abandoning the $44 billion deal.

In response, Musk laughed off Twitter’s threat to force him to buy the company. He tweeted images of him laughing along with caption messages: “They said I couldn’t buy Twitter. Then they wouldn’t disclose bot information. Now they want to force me to buy Twitter in court. Now they have to disclose bot information in court.”

The issue of fake accounts has been a major sticking point in closing the Musk-Twitter buyout deal. While Twitter insists that fewer than 5% of its accounts may be fake, Musk has argued that at least 20% of the accounts are bogus. Apart from the fake accounts, Musk also brought up the issue of Twitter acting without his consent as part of the reasons for terminating the agreement.

The Musk-Twitter Saga

Although Musk and Twitter are girding to fight it out in court, they may eventually decide to settle out of court to avoid a potentially lengthy, costly, and messy showdown. For example, the issue may be settled if Twitter releases fake account information that satisfies Musk. Another possible compromise may include Twitter accepting a lower buyout price to save the deal. If they part ways, then Twitter or Musk might have to pay $1 billion in termination fees.

Wall Street Calls for a Hold on TWTR

On July 11, Truist Financial analyst Youssef Squali reiterated a Hold rating on Twitter stock with a price target of $50, which implies 53% upside potential.

The stock has a Hold consensus rating based on one Buy and 24 Holds. The average Twitter price forecast of $46.72 implies 43% upside potential to current levels.

Bloggers Are Fairly Bullish About Twitter

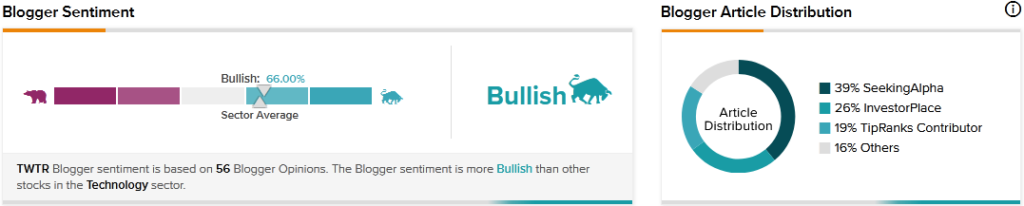

TipRanks data shows that financial blogger opinions are 66% Bullish on TWTR, compared to a sector average of 65%.

Key Takeaways for Investors

In addition to the fear of a recession that has rattled markets across the board, the buyout debacle has added another dose of uncertainty for Twitter investors. However, Twitter, a profitable social media company in a growing industry, remains an attractive business with a chance to survive on its own if the Musk deal falls through. Moreover, if Musk refuses to complete the transaction that he started, then Twitter may draw buyout interest from other companies.

Read the full Disclosure