Drugmaker Eli Lilly & Co (LLY) said that the U.S. Food and Drug Administration (FDA) has approved a supplemental Biologics License Application (BLA) for its Taltz injection used for the treatment of active non-radiographic inflammatory arthritis affecting joints and the spine.

A first-in-class milestone for the treatment, the approval makes Taltz the first antagonist to be approved by the FDA for inflammatory arthritis, also known as Axial Spondyloarthritis (nr-axSpA), which is a disease mainly affecting the sacroiliac joints and the spine, the company said in a statement.

“We recognize that many patients living with this condition suffer from chronic inflammatory back pain and other symptoms of inflammation for years before being diagnosed, and we’re excited about the possibility of these patients finding relief with Taltz,” said Patrik Jonsson, senior vice president and president of Lilly Bio-Medicines. “This approval reflects Lilly’s continued growth and commitment to supporting rheumatologists and people with autoimmune conditions.”

The approval is based on the results from a Phase 3 COAST-X trial, which evaluated improvement in signs and symptoms of nr-axSpA compared to placebo. The safety profile of Taltz in patients with nr-axSpA was consistent with previous experience with Taltz in other approved indications, the company said. This marks the fifth approval for Taltz by the FDA since 2016. Since its launch, about 137,000 patients have been treated with Taltz worldwide, with about 80,000 of those in the U.S.

Shares in Eli Lilly have been on a winning streak since March 23, advancing 28% to $152.95 as of Friday’s close.

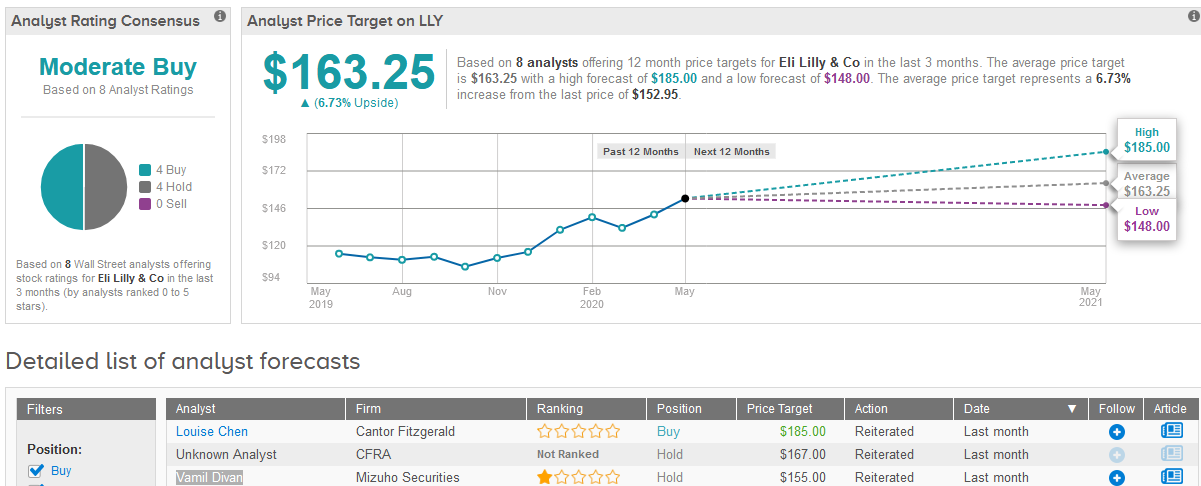

Mizuho Securities analyst Vamil Divan has a Hold rating on the stock with a $148 price target amid expectations of slightly lower sales for the company’s Alimta, Taltz and Basaglar. However, overall Divan asserts that Lilly’s product mix is likely to be more resilient to COVID-19 pressures.

Wall Street analysts are cautiously optimistic about Lilly’s stock outlook. The Moderate Buy consensus is evenly divided between 4 Buy and 4 Hold ratings. The $163.25 average price target implies 6.7% upside potential in the shares in the coming 12 months. (See Eli Lilly’s stock analysis on TipRanks).

Related News:

Eli Lilly Starts Dosing Patients In World’s First Covid-19 Antibody Trial

Pfizer Loses 6% On Disappointing Ibrance Breast Cancer Outcome

Novavax Seeks To Make 1 Billion Covid-19 Vaccine Doses