Eli Lilly & Co. has inked an agreement to snap up Prevail Therapeutics for a total consideration of up to $1.04 billion, as the US drugmaker seeks to broaden its gene therapy pipeline. Lilly shares closed 6% higher on Tuesday, while Prevail exploded 82%.

According to the terms of the deal, Lilly (LLY) will pay $22.50 per share in cash to Prevail shareholders, which translates into an 80% premium to the stock’s Monday close. The transaction also includes one non-tradable contingent value right worth up to $4 per share in cash, following the first regulatory approval of a product from Prevail’s pipeline.

Prevail is a biotechnology company developing potentially disease-modifying AAV9-based gene therapies for patients with neurodegenerative diseases. As a result of the acquisition, Lilly will develop a gene therapy program that will be based on Prevail’s portfolio of clinical-stage and preclinical neuroscience assets, which includes potential therapies for patients with Parkinson’s disease and Alzheimer’s disease.

“Gene therapy is a promising approach with the potential to deliver transformative treatments for patients with neurodegenerative diseases such as Parkinson’s, Gaucher and dementia,” said Mark Mintun, vice president of pain and neurodegeneration research at Lilly. “The acquisition ofPrevail will bring critical technology and highly skilled teams to complement our existing expertise at Lilly, as we build a new gene therapy program anchored by well-researched assets.”

The transaction, which is not subject to any financing condition, is expected to close in the first quarter of 2021.

In a separate statement, Lilly provided financial guidance. For 2021, the drugmaker expects revenue to be between $26.5 billion and $28 billion, topping analysts’ expectations of $26.47 billion. The company sees growth to be driven by key products, including Trulicity, Taltz, Verzenio, Jardiance, Olumiant, Cyramza, Emgality, Tyvyt, and Retevmo. In addition, it expects to generate between $1 billion to $2 billion of sales from its COVID-19 therapies.

Following the updates, Mizuho analyst Vamil Divan reiterated a Hold rating on the stock with a $156 price target, saying that he is looking for more details on both announcements.

“The Prevail deal checks the boxes for what Lilly was looking for, and we believe makes strategic sense at a reasonable price,” Divan wrote in a note to investors. “The financial guidance is perhaps a little better than what investors were expecting.” (See Eli Lilly’s stock analysis on TipRanks).

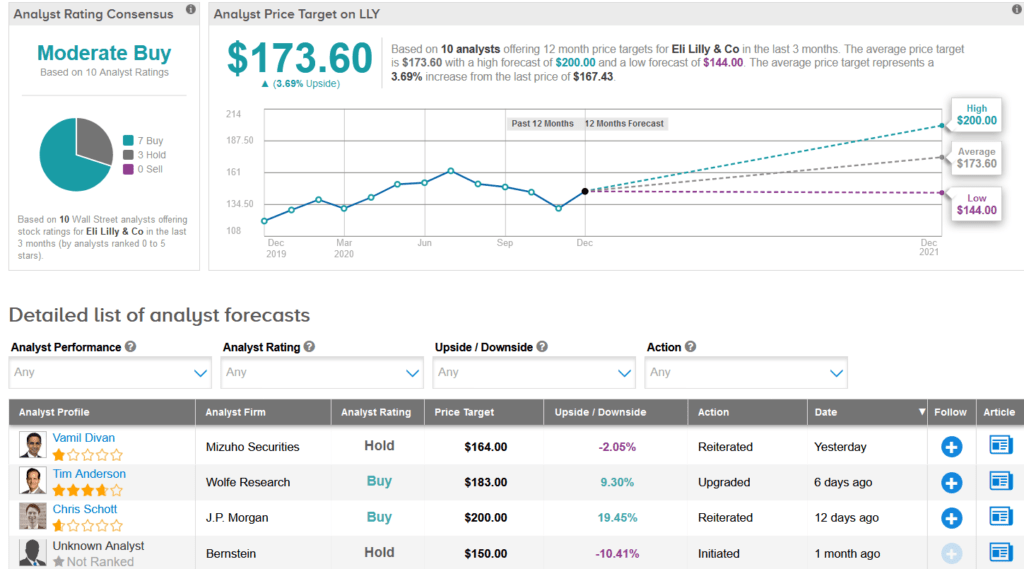

Shares of LLY have advanced 27% this year and Wall Street analysts have a cautiously optimistic Moderate Buy consensus on the stock. That’s with an average analyst price target of $173.60, indicating 3.7% upside potential lies ahead over the coming year.

Related News:

Eli Lilly, UnitedHealth Partner On Covid-19 Study In High-Risk Patients; Shares Rise

Cerner Ramps Up Dividend By 22%; Street Says Buy

TE Connectivity To Hike Dividend By 4%; Street Is Bullish