Amongst all the Big Tech names piling on the gains in last year’s AI-driven bull market, Eli Lilly (NYSE:LLY) gave some representation for the Big Pharma camp. Last year has yielded returns of 61%, and the trend has continued this year, with the stock up by 15% since 2024 entered the frame.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While AI has been the big theme on Wall Street over the past year, LLY’s success can be directly linked to its favorable positioning in another space, that of weight loss drugs. In November, the FDA granted approval for the company’s Zepbound (tirzepatide) injection, a unique obesity treatment that activates both GIP (glucose-dependent insulinotropic polypeptide) and GLP-1 (glucagon-like peptide-1) hormone receptors. The company already markets tirzepatide as Mounjaro, a treatment for type 2 diabetes.

With the company’s Q4 report coming up tomorrow (February 6), these drugs (and the potential of others) form the basis of J.P. Morgan analyst Chris Schott’s positive thesis.

“LLY remains one of our favorite names in the group as we see further upside to Street estimates as Mounjaro continues to ramp, Zepbound fully launches in 2024, and with donanemab potentially representing another growth opportunity in 2025+,” the analyst explained. “In addition, shares should benefit from a number of important catalysts in 2024 including initial tirzepatide health outcomes data and manufacturing capacity improvements, and we expect to see ph3 data for orforglipron/retatrutide in 2025.”

For Q4, Schott is calling for revenue of $8.97 billion, more or less the same as the guide and Street’s forecast, with Mounjaro sales of ~$1.9 billion (+$134 million vs. consensus) once again responsible for growth. Due to its late quarter launch and likely limited payer coverage, Schott sees Zepbound sales of just $50 million. Schott’s EPS forecast of $2.21 (which factors in an IPR&D impact of $0.62) is the same as consensus too.

Looking ahead to 2024, boosted mainly by both Mounjaro (sales of $9.5 billion, up 97% year-over-year) and a “strong ramp” resulting in Zepbound sales of $1.7 billion, Schott sees revenue growing by 16% y/y (or 23.4% excluding ~$2.0 billion of divestiture sales in 2023) to reach $39.2 billion. At the bottom-line, the analyst is calling for EPS of $12.09 (up by 19% y/y excluding IPR&D).

Looking even further down the line, forecasting the incretin franchise at $50 billion+ by 2030 and growing even bigger from there, Schott expects “unprecedented growth for LLY over the next decade.”

That said, while Schott remains a LLY bull with an Overweight (i.e., Buy) rating for the stock, his current price target of $650 leaves no room for share price growth at present. It will be interesting to see whether Schott lifts his price target after the earnings report. (To watch Schott’s track record, click here)

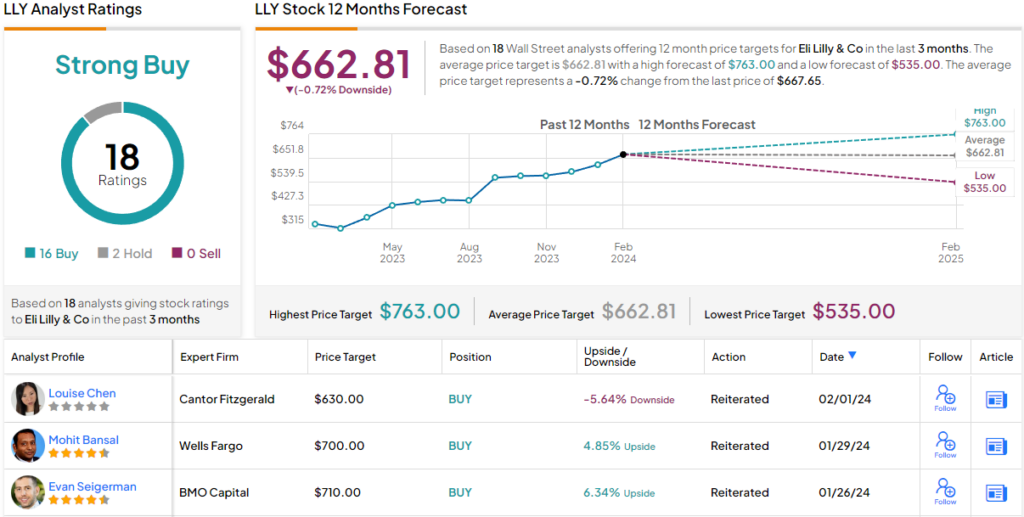

It seems to be a similar story amongst most of Schott’s colleagues; the stock claims a Strong Buy consensus rating, based on 16 Buys vs. 2 Holds. However, the $662.81 average target is only slightly higher than Schott’s objective and factors in modest downside. This is most likely a result of the past year’s surge and analysts’ inability to turn around new price targets so quickly. (See LLY stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.