You have to give a healthcare stock like Eli Lilly (NYSE:LLY) credit for trying to expand a market. It’s looking for a new plan to try and expand the market for its weight loss drug line, but in a direction that might be leaving investors cold. Moreover, it’s not the only drug company looking to make such a move, and the competition isn’t helping matters. Eli Lilly is down somewhat in Friday afternoon’s trading as a result.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Eli Lilly’s line of obesity drugs, otherwise known as GLP-1 agonists, have been delivering impressive results for patients and its bottom line accordingly. Sufficiently so that rival Novo Nordisk (NYSE:NVO) has also been pushing into this market. Yet even as Eli Lilly looks to expand, some are wondering if it’s going too far, as evidenced by today’s downturn. Eli Lilly wants to market its weight loss drugs toward children as young as six years old. Currently, Eli Lilly is starting Phase 1 studies with Mounjaro, an anti-diabetes medication, for patients between the ages of six and 11 years old.

Certainly, Eli Lilly’s Mounjaro has delivered. A study from the South China Morning Post revealed that, after about a year and a half, people lost an average of 59 pounds thanks to a combination of diet, exercise, and Mounjaro. Hard to argue with results like that. However, it might be going just a bit too far to open up the field to children, whose bodies are changing on an almost daily basis. While childhood obesity is certainly a problem, and addressing it early can prevent problems, the idea of further medicating our children to reach some ideal could be interpreted as overly aggressive.

Is Eli Lilly a Buy, Sell, or Hold?

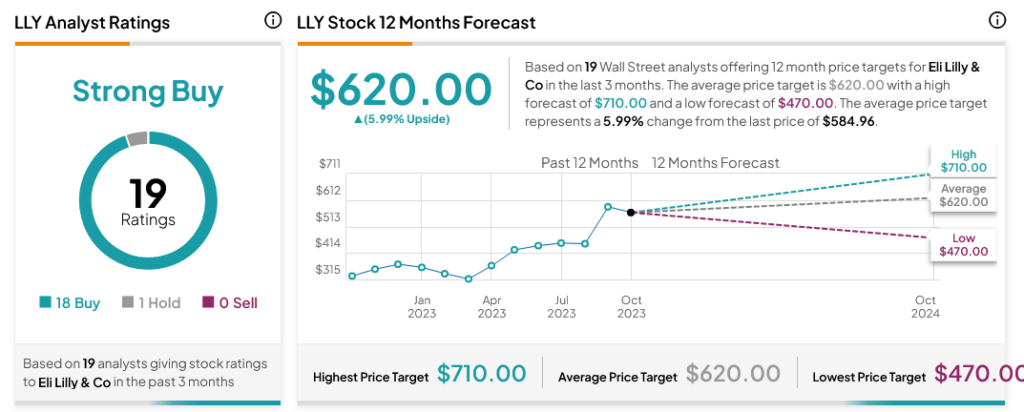

Turning to Wall Street, analysts have a Strong Buy consensus rating on LLY stock based on 18 Buys and one Hold assigned in the past three months, as indicated by the graphic below. Furthermore, the average LLY price target of $620 per share implies 5.99% upside potential.