Weight-loss drugs are all the rage these days, and for biotech stocks like Eli Lilly (NYSE:LLY) that have a dog in this fight, it should ultimately prove to be good news. However, shares of Eli Lilly were down fractionally in Tuesday afternoon’s trading after discovering a small problem with Eli Lilly’s Zepbound.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The problem with Zepbound wasn’t so much that it didn’t work or had some kind of unfortunate side effect. Rather, the problem was that it worked until users stopped taking it. When they did, patients quickly regained a decent portion of the weight they had lost while taking Zepbound. Reports noted that Zepbound users put back about half the weight they lost after a year without the drug. This basically means that anyone who wants to keep the weight off will have to stay on once-weekly Zepbound for life.

Perhaps It’s Not That Bad

While the revelation that Zepbound is only useful as long as you’re taking it certainly seemed like a shot across the bow for Eli Lilly, reports suggest it may not be that bad. For instance, several other weight-loss drugs like Novo Nordisk’s (NYSE:NVO) Wegovy actually had similar drawbacks. Without the drug, the weight comes back, though not quite as hard as it did when it left.

Eli Lilly did have some other troubles, though, starting with some price control issues from the Inflation Reduction Act that limited the price of insulin. Further, with some drugs like Trulicity coming off patent in 2027, that could potentially limit future growth.

Is Eli Lilly a Buy, Sell, or Hold?

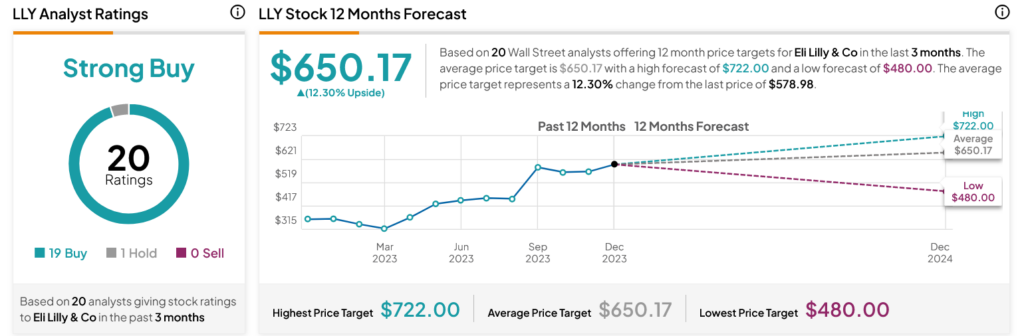

Turning to Wall Street, analysts have a Strong Buy consensus rating on LLY stock based on 19 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 63.03% rally in its share price over the past year, the average LLY price target of $650.17 per share implies 12.3% upside potential.