Shares of video game titan Electronic Arts (EA) are up in today’s trading session. The big news of the day featured a possible buyout in progress, but with doubt emerging, the gains pulled back. Word emerged earlier today that Amazon (AMZN) was poised to make a play for Electronic Arts. With such a move, Amazon would have joined in the buying action previously seen at Microsoft (MSFT) and, to a lesser extent, at Sony (SONY).

Despite this, word soon followed that Amazon wasn’t actually planning to buy Electronic Arts after all.

The last 12 months for Electronic Arts shares have been erratic, to say the least. Peaks are followed by plunges with alarming rapidity, and it’s seldom long before the next peak steps in. Yet the trading range is fairly tight; last year, at this time, EA shares ran about $143 each.

Late September saw that drop to around $126. Early October saw prices recover to about $143 again. The pattern of rapid ups and downs continued to this very day, where EA is trading around $133.

Electronic Arts is a name to be reckoned with in the video game industry. If Amazon really does have ambitions in the video game sector, then picking up EA would absolutely be a way to make a mark therein.

Though this rumor may or may not pan out, there’s still quite a bit of value in EA. I’m a bit concerned about its overall trajectory. However, I’m still ready to be bullish on one of the biggest names in gaming around.

Investor Sentiment on EA Stock Calls for Cautious Optimism

Analysts seem cautiously optimistic about Electronic Arts’ chances. Investor sentiment, meanwhile, seems to mirror that assessment nicely. Currently, Electronic Arts has a Smart Score of 9 out of 10 on TipRanks. That’s the second-highest level of “outperform” and the second-highest score altogether. That suggests that Electronic Arts has an excellent chance of doing better than the broader market.

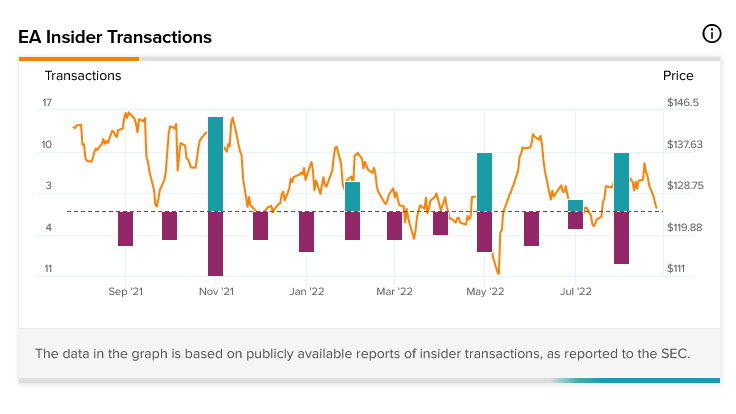

Yet, the optimism is much more cautious among EA insiders. Insider trading at Electronic Arts is fairly heavily sell-weighted, especially recently. Insiders sold a combined total of $6.6 million worth of shares just in the last three months. In aggregate, there were 12 buy transactions posted against 18 sell transactions. Multiple informative buys and sells took place just in the last month alone.

Pulling back to the last year, meanwhile, shows a fairly clear sell-weighting. The last 12 months featured 73 sell transactions against 43 buy transactions. Interestingly, EA insiders had an odd tendency to buy almost every three months.

There was a hefty surge of buying in October 2021, then no buying at all until January. Then, once more, there was no buying until April. Only the latest period broke the pattern, with two purchases in June before another surge in July.

Amazon Has Large Video Game Ambitions

While it looks like the reports of Amazon buying EA were, at best, premature, the notion is still something to consider. Such a move might have been very big for Amazon, but then, it might have taken some time to get properly off the ground. Amazon has made little secret about its video game ambitions. Amazon’s purchase of Twitch back in 2014 drove that point home pretty well.

Now that Twitch is mentioned in virtually the same breath as YouTube when it comes to game streaming, that purchase’s value becomes clear.

EA has a large number of attractive properties that would catch interest. Amazon even has some connection with EA already; a look at Amazon’s Gaming Prime section features one major EA property right off the bat: FIFA 22.

Amazon’s own development processes haven’t exactly struck a lot of gold. Games like “Lost Ark” and “New World” aren’t really household names. They do have their supporters, though.

Thus, by buying EA, Amazon would have had an array of developers at its disposal and a good slug of intellectual property to work with. There’s only one problem with that, though; EA’s development cycles of late haven’t exactly brought out a lot to work with, either.

Back in May, IGN got a look at all the games EA had in development. That was close to the start of summer. What did EA have in development at the time? The answer is, sadly, not much. Two racing games were on the slate, “Grid Legends” and a new “Need for Speed” entrant. There was a remake of “Dead Space,” three more “Star Wars” games, and new installments of “Dragon Age” and “Mass Effect,” among others.

Reaction to such a slate was tepid at best. Some found excitement with some elements of the list. Others much less so. One title, dubbed “RustHeart,” drew some interested looks as it was a new piece of intellectual property.

So the good news is, had Amazon actually gone through with its purchase, it would have had access to the complete EA catalog. That’s no small number of games and properties to work with. The bad news is that it would have had access to the complete EA catalog, which EA itself is doing shockingly little with aside from churning out sequel after sequel.

EA didn’t even run an EA Live event back in June to correspond with the E3 event that never happened this year. That suggests the company has little to show and may not have a whole lot in the wings ahead of video game prime time: the holiday shopping season. EA still plans “some surprises,” however, so that may be where we get the bulk of any release information for the rest of 2022.

Many releases originally slated for 2022 got delayed to 2023 for a variety of reasons. Everything from supply chain issues to COVID-19 lockdowns stepped in to slow the pace of releases. However, that also means that the rest of the year is looking pretty barren and won’t help much when the next earnings season comes out for EA.

Is EA Stock a Buy or Sell?

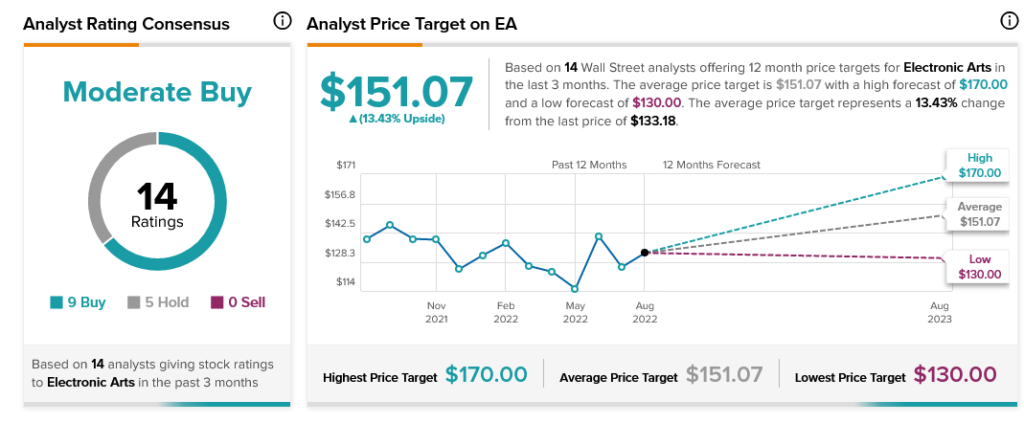

Turning to Wall Street, Electronic Arts has a Moderate Buy consensus rating. That’s based on nine Buys and five Holds assigned in the past three months. The average EA price target of $151.07 implies 13.4% upside potential. Analyst price targets range from a low of $130 per share to a high of $170 per share.

Conclusion: Investors Should be Cautiously Optimistic about EA Stock

I am cautiously optimistic about EA stock. No one can take away the fact that EA is still one of the biggest names around when it comes to game publishing. It’s got a huge quantity of intellectual properties on its side. It’s got a massive stable of developers. Best of all, it’s even got a string of projects currently under development. While the Amazon deal might have really sparked things up by giving EA a huge new slug of development cash, EA is still worth considering by itself.

Throw in the fact that EA is trading near its lowest price targets, and that only offers further encouragement. Granted, EA doesn’t have much coming out right now. Many of its biggest titles likely won’t see the light of day until 2023, like many other releases poised to emerge in 2022. That won’t be helpful in the short term.

However, once the releases start coming out again—likely in a few months—then EA might well see a resurgence. Getting in before that potential resurgence could be a smart play.